APY vs PM-SYM: For millions of Indians in the unorganised sector, planning for retirement can feel uncertain—income is often irregular and private pension products can be confusing. The Government of India offers two simple, low-cost options that pay from age 60: Atal Pension Yojana (APY) and Pradhan Mantri Shram Yogi Maan-Dhan (PM-SYM). This guide gives a clear, side-by-side comparison of eligibility, contributions, pension benefits, spouse/family provisions, and how to enroll—so you can quickly understand how each scheme works and shortlist the one that fits your situation. (Information only; not financial advice. Please verify details on official portals.)

Atal Pension Yojana (APY)

What it is

A government-backed, contributory pension for citizens—especially unorganised workers. You choose a pension slab (₹1,000 / ₹2,000 / ₹3,000 / ₹4,000 / ₹5,000 per month) and pay small, auto-debited contributions until age 60; then the chosen pension is paid for life.

Eligibility

- Age 18–40, Indian citizen

- Bank/post-office savings account with KYC (Aadhaar, mobile)

- New income-tax payers cannot enroll from 01-Oct-2022 (pre-Oct-2022 subscribers may continue)

Key benefits

- Guaranteed pension from age 60 (slab selected at enrollment)

- Spouse protection: spouse receives the same pension for life; nominee gets corpus after both pass away

- Tax deduction under Section 80CCD (subject to your tax regime/eligibility)

Contributions

Age-linked monthly amounts until 60 (earlier entry = lower monthly for the same slab). Runs via auto-debited payments; keep balance on the debit date to avoid penalties/suspension.

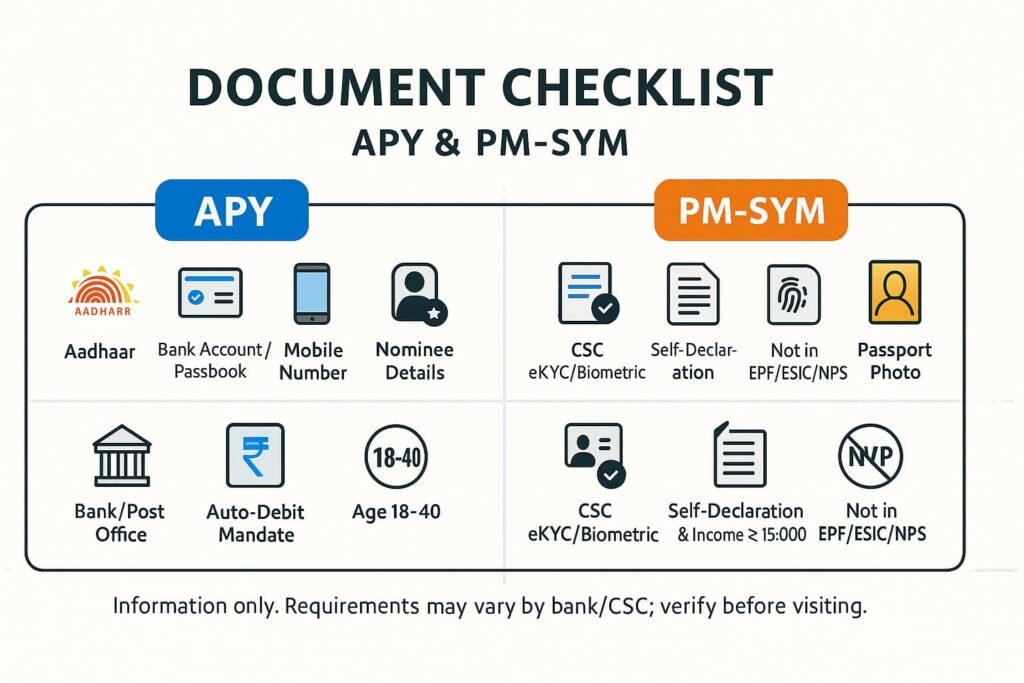

How to enroll

Apply at your bank or post office; complete KYC, select the pension slab, and enable auto-debit.

Pradhan Mantri Shram Yogi Maan-Dhan (PM-SYM)

What it is

A voluntary, contributory pension for unorganised workers. You pay a small age-based amount every month until age 60 and receive a guaranteed ₹3,000/month pension for life. The Government matches your contribution 1:1.

Eligibility

- Age 18–40

- Monthly income ≤ ₹15,000

- Unorganised worker; not an income-tax payer; not covered by EPF/ESIC/NPS

- Aadhaar, bank account, mobile number

Key benefits

- ₹3,000/month pension from age 60

- 50% family pension to spouse after subscriber’s death

- 1:1 Government matching of your monthly contribution

- Auto-debit setup; minimal maintenance

Contributions

Age-linked monthly amounts until 60; joining earlier keeps the monthly outlay lower.

How to enroll

Apply at a Common Service Centre (CSC) with Aadhaar and bank details; complete eKYC and enable auto-debit.

APY vs PM-SYM — Quick Comparison

Two pension options by the Government of India. Read the simple points below and pick what matches your situation.

| Feature | APY (Atal Pension Yojana) | PM-SYM (Shram Yogi Maan-Dhan) |

|---|---|---|

| Pension at 60 | APY ₹1,000–₹5,000 / month You choose | PM-SYM ₹3,000 / month Fixed |

| Who can join | APY Age 18–40, Indian citizen, bank/post-office account + KYC. New income-tax payers can’t enroll (from 01-Oct-2022). | PM-SYM Age 18–40, unorganised worker, income ≤ ₹15,000/month, not an income-tax payer, not in EPF/ESIC/NPS. |

| What you pay each month | APY Age-based amount; earlier you join, less you pay for the same pension. Auto-debit from bank/post office. | PM-SYM Age-based amount; Government adds the same amount (1:1). Auto-debit after enrollment. |

| Family pension | APY Spouse gets the same pension for life; after both pass away, nominee gets corpus. | PM-SYM Spouse gets 50% of the pension after subscriber’s death. |

| Where to enroll | APY Your Bank / Post Office | PM-SYM Common Service Centre (CSC) |

| Good for | APY Those who want the option to aim for more than ₹3,000/month by choosing a higher slab. | PM-SYM Those with low/irregular income who want a simple, fixed ₹3,000/month with Govt support. |

Information only. Please verify details on official portals or with a qualified advisor before applying.

Comparison of Contribution & Withdrawal Rules

A quick look at how payments are made, what happens if you miss them, and the options to exit early.

| Rule | APY | PM-SYM |

|---|---|---|

| Contribution frequency | APY Auto-debit. Monthly, with option in many banks for quarterly or half-yearly schedules. | PM-SYM Auto-debit. Monthly schedule (age-based amount). |

| If you miss a payment | APY Small late charges may apply. Account can turn inactive/suspended if debits keep failing. You can usually reactivate by paying arrears + charges and keeping balance ready. | PM-SYM Account may go default/inactive on repeated failures. You can generally resume by clearing pending amounts; Government matching pauses while in default. |

| Can you pause contributions? | APY No formal “pause”, but missed debits can be regularised later. Consider quarterly/half-yearly options if income is irregular. | PM-SYM No formal “pause”. If you stop paying, the account becomes inactive; you can restart by paying dues. |

| Voluntary exit before 60 | APY Generally restricted. In permitted exits (e.g., death/terminal illness, or as per current rules), refund is your own contributions + earnings after scheme deductions. | PM-SYM More restrictive. Early exit usually returns your contributions + interest; the Government’s matching share is typically not paid out. |

| What is paid on early exit | APY Refund of subscriber’s contributions with applicable earnings (net of charges). Pension choice ends. | PM-SYM Refund of subscriber’s contributions with interest as per rules; Government share is forfeited. Pension choice ends. |

| Death / severe illness | APY On death, spouse may get the same pension for life after 60 or opt for refund as per rules. For terminal illness, refund options apply per scheme provisions. | PM-SYM On death, spouse may get 50% family pension after 60 or close the account with refunds as per provisions. |

Notes: Penalties, interest and exit conditions are as per scheme rules and may change. Confirm details at enrollment.

Tax and Inflation Analysis

Tax benefits (old vs new regime)

- APY: Individual contributions qualify under Section 80CCD(1) (within the overall ₹1.5 lakh limit) and also an additional ₹50,000 under Section 80CCD(1B).

- PM-SYM: No specific deduction is provided in the Income-tax Act like 80CCD for APY/NPS. Treat PM-SYM contributions as not tax-deductible unless rules change.

- New tax regime note: Deductions under 80C/80CCD(1)/(1B) are generally not available in the new regime; the above APY deductions apply to the old regime.

Information only—tax treatment depends on your chosen regime and personal filing.

Inflation impact (real purchasing power)

Both schemes pay a fixed pension in rupees from age 60. Prices usually rise over time, so the purchasing power falls. The tables below show the approximate value in today’s money at different inflation rates (rounded).

If pension starts in 20 years (e.g., join at 40)

| Pension option | 4% inflation | 5% inflation | 6% inflation |

|---|---|---|---|

| APY ₹5,000fixed amount | ≈ ₹2,282 (today’s value) | ≈ ₹1,884 | ≈ ₹1,559 |

| PM-SYM ₹3,000fixed amount | ≈ ₹1,369 | ≈ ₹1,131 | ≈ ₹935 |

If pension starts in 30 years (e.g., join at 30)

| Pension option | 4% inflation | 5% inflation | 6% inflation |

|---|---|---|---|

| APY ₹5,000 | ≈ ₹1,542 | ≈ ₹1,157 | ≈ ₹871 |

| PM-SYM ₹3,000 | ≈ ₹925 | ≈ ₹694 | ≈ ₹522 |

Method: real value ≈ nominal pension ÷ (1 + inflation)years. Results are illustrative and rounded.

Analysis — Which Scheme Might Fit Whom?

Scenario 1: “I want the option of a higher pension.”

APY lets you aim for more than ₹3,000/month by selecting a higher slab (up to ₹5,000). PM-SYM is fixed at ₹3,000/month. Remember: joining APY later (closer to age 40) means a higher monthly contribution for the same target pension.

Scenario 2: “My income is low or irregular; I need support.”

If you meet PM-SYM rules (unorganised worker, income ≤ ₹15,000/month), the scheme provides a fixed ₹3,000/month pension at 60 and the Government matches your age-based contribution 1:1, reducing your out-of-pocket cost.

Scenario 3: “I want something simple to set up and forget.”

Both schemes run on auto-debit and start from age 60. PM-SYM is simpler because the pension is fixed at ₹3,000 and the contribution is set by age. APY needs you to choose a slab (₹1k–₹5k) first and contribute accordingly.

Eligibility guardrails (quick check)

- APY: Age 18–40; bank/post-office savings account with KYC. New income-tax payers cannot newly enroll after 01-Oct-2022 (existing accounts may continue).

- PM-SYM: Age 18–40; unorganised worker; monthly income ≤ ₹15,000; not an income-tax payer; not covered by EPF/ESIC/NPS.

Conclusion: Make an Informed, Document-Backed Choice

Both APY and PM-SYM aim at old-age income security and are designed to be affordable and easy to maintain. Your choice should match your income pattern, eligibility, and comfort with contributions.

Choose APY if…

- You value flexibility to target a higher pension (up to ₹5,000/month).

- You meet eligibility rules (age 18–40, account + KYC, and current APY rules).

- You can sustain the required monthly contribution until age 60.

Choose PM-SYM if…

- You are an unorganised worker with income ≤ ₹15,000/month and meet the scheme rules.

- You prefer a fixed ₹3,000/month pension from age 60.

- You will benefit from 1:1 Government matching of your monthly contribution.

- Verify eligibility, contribution amount, and exit rules before enrolling.

- Keep auto-debit active and maintain balance on the due date.

- Store statements/acknowledgments safely for your records.

Information only. Please confirm details on official portals or with a qualified advisor.

About Seva Funds & Important Disclosures

About the Author

Prashant SN

Education: MCom (Master of Commerce)

What I enjoy: Finance calculations and building easy tools for everyday decisions

Hi, I am Prashant SN. I studied MCom and I am interested in finance calculation. I started Seva Funds to share clean, fast calculators and no-nonsense explanations for India.

Disclaimer

This website and its content are for informational and educational purposes only. It is not intended to be and does not constitute financial, legal, or any other type of professional advice. We do not guarantee the accuracy, completeness, or usefulness of any information on the site. Always consult with a qualified financial professional before making any financial decisions.