Tax exemption for senior citizens is about making retirement income—pension, savings interest, and small investments—work harder by using the right rules at the right time. This guide explains how age bands (60–79 and 80+) affect your zero-tax threshold, helps you compare the Old vs New Regime without jargon, and shows where seniors commonly save—like claiming 80TTB on bank/post-office interest, 80D for health insurance and medical costs, and the standard deduction on pension. You’ll also learn the essentials of Form 15H and TDS so banks don’t over-deduct, plus quick, practical examples that tie everything together.

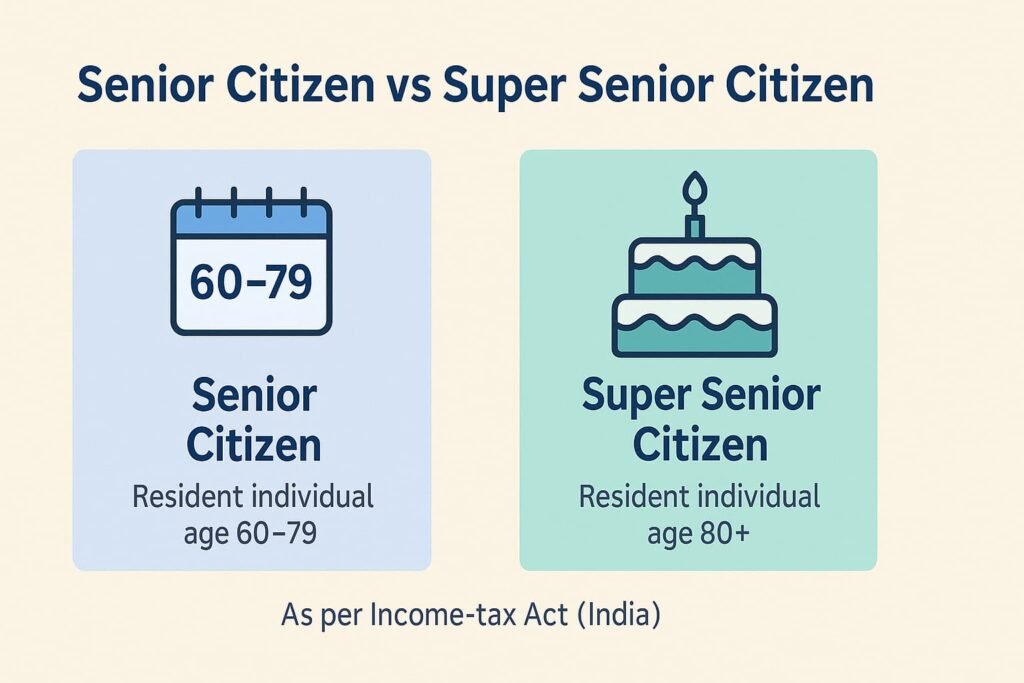

Who Qualifies as a Senior Citizen?

Simple definitions (as per Income-tax law):

- Senior Citizen: A resident individual who is 60 years or older but below 80 at any time during the financial year.

- Super Senior Citizen: A resident individual who is 80 years or older at any time during the financial year.

The Core Benefit — Higher Basic Exemption Limits (Old Regime)

The basic exemption limit is the portion of income taxed at 0%—the amount you can earn without paying tax. Under the Old Tax Regime, this 0% band is higher for senior citizens, giving more room before slab rates apply. (These higher limits apply to resident individuals.)

- Normal citizen (<60) ₹2,50,000

- Senior citizen (60–79) ₹3,00,000

- Super senior (80+) ₹5,00,000

Old vs New Tax Regime — A Quick Comparison

Clean, mobile-first cards to decide which regime fits senior citizens best. Skim each card: left shows the Old Regime, right shows the New Regime.

Higher for seniors: ₹3,00,000; super-seniors: ₹5,00,000 (resident individuals).

Common slabs for all ages; zero-tax slab generally starts at ₹3,00,000.

PPF, LIC, ELSS, home-loan principal, etc. Allowed within the overall ₹1.5 lakh cap. Allowed

Not allowed (generally). Not allowed

Seniors can claim up to ₹50,000 (within 80D rules). Allowed

Not allowed. Not allowed

Resident seniors: deduction up to ₹50,000 on savings/FD/RD/post-office interest. Allowed

Not allowed. Not allowed

₹50,000. Allowed

₹50,000. Allowed

Deduction available (limits & conditions apply). Allowed

Not allowed for self-occupied property. Not allowed

Available per section-wise rules. Allowed

Generally not allowed. Not allowed

Available up to the FY-specific income threshold.

Available up to the FY-specific income threshold.

Exempt from paying advance tax; pay self-assessment before filing.

Same relief; regime-agnostic condition.

Eligible if only pension + interest from the same specified bank and declaration submitted.

Same conditions; the bank computes tax and deducts TDS if eligible.

Submit Form 15H if total tax is nil to avoid TDS; senior TDS threshold on interest applies.

Same approach: use Form 15H where eligible; threshold rules remain.

* 80TTB applies to resident senior citizens (60+). Rebate thresholds (87A) and slab numbers can change—always check the current financial year before filing.

Key Deductions & Exemptions for Senior Citizens (Old Regime focus)

The most-used reliefs seniors can legally claim. Use these when comparing the Old vs New Regime.

1) Section 80TTB — Interest Income Deduction ₹50,000

Interest from bank/post office savings, fixed deposits, recurring deposits, and similar deposit schemes.

Up to ₹50,000 per financial year (for resident senior citizens).

Deposits are a common retirement income—this deduction directly lowers taxable income.

2) Section 80D — Health Insurance & Medical up to ₹50,000

Premiums up to ₹50,000; preventive check-ups are within this limit (sub-caps may apply).

If you pay for your senior parent’s policy, you can claim another ₹50,000 (subject to overall 80D rules).

Medical expenses tend to rise post-retirement; 80D offers meaningful relief in the Old Regime.

3) Standard Deduction on Pension ₹50,000

Many pensioners are treated like salaried taxpayers for this purpose; a flat ₹50,000 reduction.

Available in both regimes. Include it when you compare Old vs New.

Other Common Items (Old Regime)

- 80C basket — PPF/EPF/ELSS/NSC/tuition fees, etc., within the overall cap.

- Section 24(b) — Home-loan interest on self-occupied property (limits apply).

- 80G donations — Eligible charitable donations, subject to rules.

Income Tax Slabs for Senior & Super Senior Citizens (Old Regime)

A quick visual of the higher zero-tax thresholds available in the Old Regime. Use this with your deductions section to estimate total tax.

Senior Citizens (60–79) Old Regime

| Net Taxable Income | Tax Rate |

|---|---|

| Up to ₹3,00,000 | NIL |

| ₹3,00,001 – ₹5,00,000 | 5% |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

Super Senior Citizens (80+) Old Regime

| Net Taxable Income | Tax Rate |

|---|---|

| Up to ₹5,00,000 | NIL |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

Rates shown before 4% Health & Education Cess and any applicable surcharge. Check the current FY rules when you file.

Quick Self-Check

Match your situation to the first benefit to review. Fully stacked cards for easy reading on mobile—no horizontal scrolling.

Deposits & Savings Interest Is Your Main Income

Section 80TTB

Lets resident seniors deduct up to ₹50,000 of interest from bank/post-office deposits—directly reducing taxable income.

High Medical Expenses, No Health Insurance

Section 80D

Allows deduction for medical expenditure (when no policy) or premium—up to ₹50,000 for seniors.

Age 75+ with Only Pension & Interest

Section 194P (ITR exemption via specified bank)

If conditions are met (same specified bank credits pension and interest, declaration filed), you may not need to file an ITR.

Choosing Between Old vs New Regime

Old vs New Regime comparison

The right choice can save tens of thousands—run both scenarios (include ₹50,000 pension standard deduction in both).

Need Cash Flow from a High-Value Home

Reverse Mortgage — tax treatment

Loan payouts are generally treated as non-taxable receipts, providing steady cash flow without selling the house.

Always confirm current FY rules and eligibility (resident status, bank specifications for 194P, etc.) before filing.

Exclusive Benefits for a Worry-Free Retirement

A) No Advance Tax for seniors without business/profession income

If you’re a resident senior citizen and you don’t have business or professional income, you need not pay advance tax. Simply pay any balance as self-assessment tax before filing your return.

Why this helps: smoother cash flow (no quarterly instalments) and simpler compliance.

B) ITR filing relief (Section 194P) for 75+ — specific, narrow conditions

If you are 75 or older and have only:

- Pension income, and

- Interest from the same specified bank that credits your pension,

…and you submit the prescribed declaration to that bank, the bank computes your total income and deducts tax. In that case, you may not need to file an ITR for that year.

Conditions to check (all must be true):

- You are a resident individual aged 75+.

- Only two incomes: pension and interest from the same specified bank (no rent, capital gains, other-bank FDs, etc.).

- The bank is notified as “specified” by the government.

- You’ve submitted the required declaration and supporting proofs.

If any extra income exists (e.g., FD interest at another bank), this relief won’t apply—you should file your ITR in the normal way.

Common Forms and What They Do

A quick, mobile-friendly reference so senior citizens can act fast and avoid paperwork surprises.

Form 15H

A declaration to your bank/post office that your income is below the taxable limit (tax payable is nil).

To stop banks from deducting TDS on interest income when no tax is actually due.

Form 16 / 16A

Certificates of Tax Deducted at Source (TDS): 16 for salary/pension, 16A for other incomes like interest.

To verify TDS deducted on pension or interest and to use the figures while filing the return.

ITR-1 (Sahaj)

The simplest income-tax return form for eligible resident individuals.

To file easily when income is from pension/salary, interest, and/or one house property (subject to eligibility rules).

AIS (Annual Information Statement)

A consolidated statement on the tax portal showing your reported incomes, TDS/TCS, and high-value transactions.

To cross-check that all income and deductions match bank/TDS certificates before filing.

Also useful: Form 26AS (tax credit statement), Form 12BBA (declaration for 75+ under Section 194P), and Form 10E (relief on salary/pension arrears) — include if relevant to your case.

How to submit Form 15H to avoid TDS on interest

Who can use Form 15H? Resident individuals aged 60+ whose total tax for the year is nil. (If you are < 60 and otherwise eligible, the equivalent is Form 15G.)

- Check eligibility: Confirm you are a resident senior (60+) and that your estimated total tax for the FY is zero after deductions (80C/80D/80TTB, etc.).

- Collect details: PAN, name & address, bank/branch & account number(s), and a simple estimate of interest for the current FY.

- Get the form: Download Form 15H from your bank/India Post site or the income-tax portal, or pick up a physical copy at the branch.

- Fill & sign: Complete Part I for the correct FY/AY, declare the estimated income, and sign the verification. Attach PAN copy if the branch asks.

- Submit to each bank/post office: Hand in at your home branch or submit online (if available). Do this early in the FY or before interest credit to prevent TDS.

- Get acknowledgement: Take a stamped copy or email receipt. Note the date and branch official’s name if submitted offline.

- Monitor TDS: Check passbook/statement and Form 26AS/AIS. If TDS is deducted by mistake, ask the bank to rectify or claim refund in ITR.

- Renew next year: Re-submit Form 15H at the start of every FY if you remain eligible, and update your interest estimate if it changes.

You’ll typically need: PAN, filled & signed Form 15H, bank/account details, and your interest estimate for the year.

Before You Submit: Quick Recap

A tax-smart retirement starts with the basics: confirm your age band (60–79 senior, 80+ super-senior), know that the Old Regime offers higher basic exemption limits for seniors while the New Regime uses common slabs, and list the deductions you actually claim—80TTB (interest), 80D (health insurance/medical), 80C, plus the ₹50,000 standard deduction on pension. Compare Old vs New with your real numbers (include the pension standard deduction in both), and remember the senior-friendly relaxations: no advance tax if you have no business/profession income, and Section 194P for those 75+ who meet the exact “pension + same-bank interest” conditions.

Next, take a few minutes to note your income sources (pension, interest, rent), medical premiums/expenses, and investments, then run a quick two-scenario calculation to see which regime lowers your tax. Keep supporting documents organized, check TDS/Form 26AS/AIS alignment, and revisit your choice each year or when Budget rules change. If your situation involves extra incomes or exemptions beyond these basics, consider a quick review with a tax professional.

FAQs — Tax Exemptions for Senior Citizens (India)

1) Who qualifies as a senior or super senior citizen?

Senior citizen: resident individual aged 60–79 during the financial year. Super senior citizen: resident individual aged 80+ during the financial year.

2) What are the higher basic exemption limits under the Old Regime?

For resident individuals: seniors get ₹3,00,000 and super seniors get ₹5,00,000 as the zero-tax basic exemption limit.

3) Do seniors get special slabs under the New Regime?

No. The New Regime uses common slabs for all ages; the zero-tax slab generally starts at ₹3,00,000.

4) What is Section 80TTB?

A deduction up to ₹50,000 on interest from bank/post-office deposits (savings, FD, RD, etc.) for resident senior citizens. Not available in the New Regime.

5) How much can seniors claim under Section 80D?

Up to ₹50,000 for health-insurance premium or specified medical expenditure (Old Regime). Generally not available in the New Regime.

6) Is the ₹50,000 standard deduction available on pension?

Yes. Pensioners typically get a ₹50,000 standard deduction in both the Old and New Regimes.

7) When should a senior submit Form 15H to avoid TDS on interest?

Submit Form 15H to your bank/post office if your total tax for the year is nil, so TDS on deposit interest is not deducted. Re-submit each financial year if still eligible.

8) What is Section 194P relief for citizens aged 75+?

If a resident aged 75+ has only pension and interest from the same specified bank and files the prescribed declaration, the bank computes tax and ITR filing may not be required for that year.

About Seva Funds & Important Disclosures

About the Author

Prashant SN

Education: MCom (Master of Commerce)

What I enjoy: Finance calculations and building easy tools for everyday decisions

Hi, I am Prashant SN. I studied MCom and I am interested in finance calculation. I started Seva Funds to share clean, fast calculators and no-nonsense explanations for India.

Disclaimer

This guide explains senior citizen tax rules in simple language for education only. It is not tax, legal, or investment advice and may not reflect your exact facts. Slabs, deductions, rebates, and compliance (e.g., Sections 80TTB, 80D, 87A, 194A, 194P) can change by Financial Year and differ between the Old and New regimes.

Key cautions for this topic: 80TTB applies to resident seniors; 80D limits and documentation apply; Form 15H should be used only if total tax payable is nil; Section 194P relief is narrow—age 75+, only pension and interest from the same specified bank, with the prescribed declaration; examples shown are before cess/surcharge and are illustrative only. Please verify with the Income-tax portal/CBDT notifications and your bank/post office, and consult a qualified tax professional for personalised advice.