Thinking about taking a loan?

Not applying yet — just thinking. Maybe you’re planning to buy a bike, cover your child’s school fees, pay for a sudden medical need, or invest in your small business. That thought — “Maybe I need a loan” — is usually followed by confusion, hesitation, and a long list of questions. Where do I apply? Will I get approved? How much can I safely borrow?

Here’s what most people don’t realize: AI for loans in India is already helping you — long before you fill out any form. From showing you real loan options to helping you avoid bad decisions, AI plays a quiet but powerful role. You may not see it, but it’s working behind the scenes to make your borrowing journey smarter, easier, and less stressful — right from the moment you start thinking.

🧠 AI Helps You Understand What’s Possible — Instantly

You’re just browsing. Maybe you open a loan app or visit a finance website.

You’re not ready to commit — you’re just curious. “Can I even get a loan?” you wonder.

That’s where AI steps in quietly, without making it a big deal.

What AI does at this stage:

Reads your basic inputs — like income, city, and job type

Instantly compares it with thousands of loan criteria from multiple lenders

Shows you a realistic loan estimate — no paperwork, no commitment

It gives you a sense of what’s actually possible for you — right now.

| Feature | Traditional Loan Process | AI-Enabled Loan Process |

|---|---|---|

| Time to check eligibility | 1–3 days | Instant (in seconds) |

| Document verification | Manual, in-person | Auto-scanned & verified |

| Language support | Mostly English | Multilingual AI chatbots |

| Offer matching | Generic offers | Personalized suggestions |

| Application steps | Long, paper-heavy | Short, mobile-friendly |

| Approval time | Days or weeks | Minutes or real-time |

🔍 AI Helps You Explore Without Pressure

When you’re just thinking about taking a loan, the last thing you want is a long, complicated form or someone pushing you to apply. AI makes this early stage easy and stress-free by guiding you gently, step by step.

How AI helps during this stage:

Keeps the questions short and relevant

Instead of showing a big form with 20 fields, AI asks just a few smart, basic questions based on your situation.Adapts to your profile as you go

If you’re self-employed, it won’t ask about salary slips. If you’re salaried, it avoids irrelevant questions about business turnover.Gives you space to explore options

You can check eligibility and preview offers without uploading documents or committing to anything — it respects your pace.Filters out lenders that don’t fit your profile

AI compares your answers with multiple lender criteria and silently removes those that would likely reject your application.Avoids overwhelming you with jargon or decisions

It explains your options in clear, simple language so you can understand them without needing to be a finance expert.

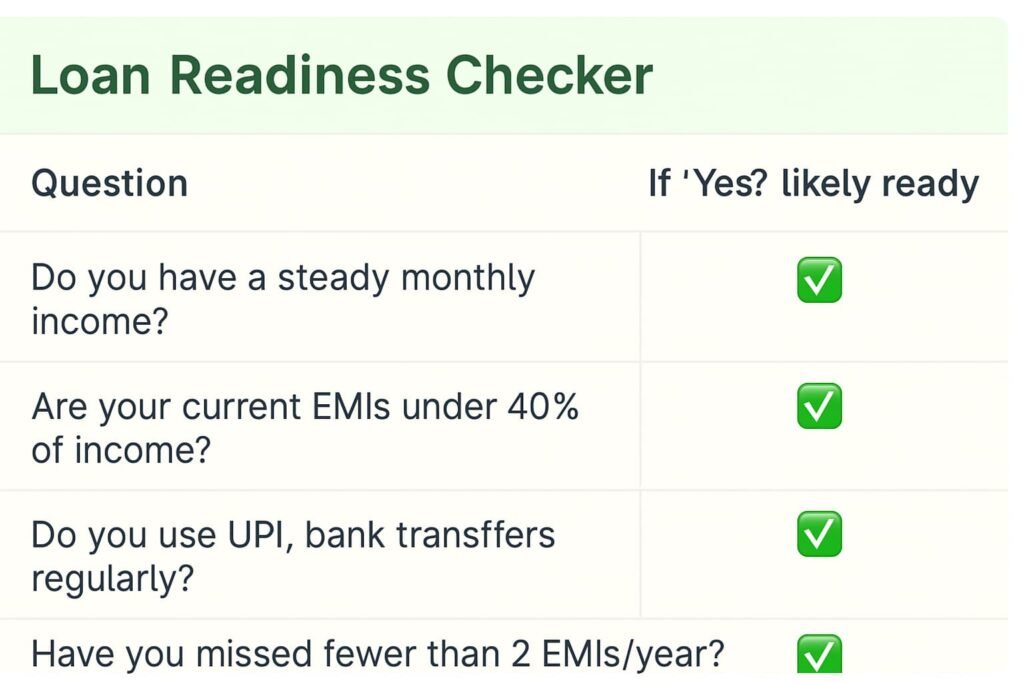

📊 AI Helps You Choose a Loan You Can Actually Handle

A lot of people make the mistake of choosing a loan that looks attractive but becomes difficult to repay. AI steps in to help you avoid this by suggesting options that actually fit your financial reality — not just what’s available.

How AI makes loan choices safer:

Analyzes your income vs expenses before suggesting anything

It looks at how much you earn and how much you typically spend, helping you avoid EMIs that could stretch your monthly budget too thin.Considers your existing financial commitments

If you’re already paying EMIs or credit card bills, AI takes that into account before showing you new offers — so you don’t end up with too many loans.Matches you with repayment plans that fit your comfort zone

Instead of pushing large loan amounts, AI recommends plans with manageable EMIs and tenures that suit your lifestyle.Avoids risky loan combinations

If a certain loan offer looks tempting but could lead to financial stress later, AI will quietly push that offer lower in the list — or not show it at all.Adjusts suggestions based on your financial behavior

If you’re regularly saving, paying on time, or have stable cash flow, AI may give you access to better options with more flexibility.

| Common Mistake | How AI Helps Prevent It |

|---|---|

| Borrowing more than needed | Recommends safe amounts based on your income and existing expenses |

| Ignoring hidden charges | Highlights fees, interest rates, and total cost clearly before you apply |

| Missing EMI due dates | Sends timely, automated reminders to keep your repayment on track |

| Falling for “0% interest” traps | Flags misleading offers with hidden processing fees or conditions |

| Applying to the wrong lenders | Filters out lenders unlikely to approve based on your profile |

🛑 AI Stops You From Making Costly Mistakes

Not all loan offers are good for you — even if they look attractive on the surface. One of the most valuable things AI does is help you avoid decisions that could hurt your finances in the long run.

How AI protects you from risky choices:

Flags loan offers with hidden charges or high interest

AI analyzes the fine print — like high processing fees or rising interest rates — and brings them to your attention before you accept anything.Identifies if you’re borrowing more than you can handle

It checks if the EMI would take up too much of your income and warns you if you’re going beyond a healthy limit.Gives timely alerts before you commit to something risky

If your choice doesn’t match your repayment ability, AI steps in to warn you, helping you pause and rethink.Reduces your chances of getting stuck in debt traps

By filtering out unsuitable lenders and expensive loan structures, AI keeps you from entering cycles of late fees or rollover loans.Helps you spot offers that are too good to be true

Flashy schemes or instant approval ads? AI can tell when a deal doesn’t make sense — and shows you safer alternatives.

📄 AI Makes the Application Process Super Simple

Once you finally decide to go ahead and apply for a loan, you don’t want a complicated process. Thanks to AI, the entire application becomes fast, smooth, and surprisingly easy — even on your phone.

How AI simplifies the application step:

Scans and verifies your documents instantly

When you upload your Aadhaar, PAN, or other ID proofs, AI reads and validates the information in seconds — no manual typing or errors.Auto-fills your details to save time

AI pulls key information like your name, address, and date of birth from your documents, so you don’t have to fill long forms.Reduces human errors during submission

It checks for blurry images, mismatched data, or missing fields — and helps you fix them immediately before submission.Eliminates the need for branch visits or physical paperwork

Everything happens digitally — securely and without delays — so you don’t have to run to a photocopy shop or bank counter.Keeps the process short and mobile-friendly

Whether you’re using a basic smartphone or a laptop, AI ensures the application experience is quick and seamless for everyone.

| Stage | AI Support Provided |

|---|---|

| Thinking | Shows eligibility, explains options clearly before you commit |

| Exploring offers | Filters and recommends best-fit loan plans based on your profile |

| Applying | Auto-verifies documents and simplifies the entire application |

| Post-loan management | Sends reminders, tracks behavior, and suggests better future offers |

🔁 AI Keeps Helping You After the Loan Too

Most people think AI’s job ends once the loan is approved and the money is disbursed. But in reality, it continues to support you even after you’ve taken the loan — and that ongoing help can make a big difference.

How AI supports you after disbursal:

Sends timely EMI reminders to avoid missed payments

AI reminds you gently before your due date, helping you stay on track and avoid penalties or late fees.Monitors your repayment behavior to adjust future options

It watches how consistently you pay and uses that data to improve your credit profile and future loan eligibility.Unlocks better offers based on your performance

If you’ve built a good repayment record, AI may suggest top-up loans, lower interest rates, or longer tenure options suited to your improved profile.Keeps communication clear and helpful

Instead of random emails or calls, you get simple, well-timed updates that are actually useful — no confusion, no spam.Supports smarter financial planning

AI can also recommend ways to manage your cash flow better, helping you balance your loan with other expenses in daily life.

🧭 AI Guides You Like a Personal Advisor

When you’re unsure about which loan to choose — or whether to take one at all — AI acts like a silent advisor. It doesn’t push you. It simply offers helpful, personalized guidance that makes your decision easier and smarter.

How AI guides you during the process:

Breaks down loan options in simple, understandable terms

No confusing finance jargon — just clear explanations of how much you’ll repay, when, and under what conditions.Suggests smarter alternatives based on your behavior

If you’re aiming for a high EMI but your spending habits suggest otherwise, AI might guide you toward a safer, more balanced option.Answers your questions in real time through smart chat support

Instead of waiting on hold or digging through FAQ pages, you get instant answers that help you move forward confidently.Highlights your best-fit offers clearly

AI ranks loan offers based on your personal profile — not ads — so you can focus on what actually suits your situation.Helps you understand what’s risky and what’s safe

If a decision might lead to repayment trouble, AI helps you understand why — so you feel in control, not confused.

🤖 FAQ: AI for Loans in India

1. What is AI in loan processing?

AI (Artificial Intelligence) in loan processing refers to technology that helps analyze your data — like income, spending habits, and documents — to quickly check your eligibility, recommend suitable offers, and speed up approval.

2. Is AI actually giving me the loan?

No, AI does not give you the loan directly. It works in the background to match you with the right lenders and helps you complete the process faster and smarter.

3. Can I trust AI to suggest the right loan?

Yes — AI is trained to analyze data objectively. It doesn’t push random offers. Instead, it suggests options based on your profile, income, and repayment capacity.

4. Is AI better than talking to a loan agent?

In many cases, yes. AI is available 24/7, speaks your language, doesn’t judge you, and compares multiple lenders instantly. But for emotional support or complex questions, human agents can still help too.

5. Does AI check my credit score?

Yes, but it also looks beyond your credit score. AI can use other data like UPI activity, regular expenses, and bank transfers — so even people without a credit history can get considered.

6. Is my personal data safe with AI-based loan platforms?

Most trusted platforms use secure encryption and do not store sensitive data like Aadhaar or PAN unnecessarily. Always use verified platforms like SevaFunds.com for safety.

7. Will AI reject my loan if I have low income?

Not necessarily. AI doesn’t reject — it evaluates. If your income doesn’t support a big loan, it may still show smaller, safer options that you’re more likely to get approved for.

8. Can AI help me after I get the loan?

Yes. AI can send EMI reminders, track repayment behavior, and even suggest better offers in the future if you build a good repayment history.

About Seva Funds & Important Disclosures

About the Author

Prashant SN

Education: MCom (Master of Commerce)

What I enjoy: Finance calculations and building easy tools for everyday decisions

Hi, I am Prashant SN. I studied MCom and I am interested in finance calculation. I started Seva Funds to share clean, fast calculators and no-nonsense explanations for India.

Disclaimer

This website and its content are for informational and educational purposes only. It is not intended to be and does not constitute financial, legal, or any other type of professional advice. We do not guarantee the accuracy, completeness, or usefulness of any information on the site. Always consult with a qualified financial professional before making any financial decisions.

📚 Related Reads from SevaFunds

Looking to make smarter financial decisions beyond loans? Explore these helpful guides:

💡 EV vs Petrol Cars — Which Is Better for Your Daily Commute?

A practical comparison for cost-conscious commuters.🧾 GST Calculation Guide for the Common Man

Understand how GST works — explained in simple terms anyone can follow.🛑 Is Early Retirement Possible in India?

Find out what it takes to retire early and live stress-free.🏠 GST on Property Purchase in India: What You Should Know

Don’t let GST confuse your dream home purchase — we break it down.