Credit card limit based on salary in India is one of the most common questions people ask when applying for a new card. Everyone wants to know how much spending power they’ll get — and sometimes it’s a shock when a friend with the same salary ends up with a bigger limit.

If you’ve been scratching your head thinking, “Why did the bank give my friend more credit when we earn almost the same?”, you’re definitely not alone. In India, people often try to guess their credit card limit purely by looking at their monthly income.

Here’s the catch — yes, your salary plays a big role, but it’s far from the only thing banks care about. The good news? With a little insider knowledge, you can estimate your limit pretty accurately and even learn how to increase it over time. Let’s keep it simple, skip the finance jargon, and break it down in plain language.

Quick, friendly snapshot to estimate your credit card limit based on salary in India. Use the table below as a starter range — your bank may go lower or higher depending on credit score, existing loans, and repayment history.

The Quick Formula Everyone Talks About Rule of Thumb

Banks usually set a starting 2×–3× of your monthly income as the credit limit.

| Monthly Salary | ~2× Limit | ~3× Limit |

|---|---|---|

| ₹30,000 | ₹60,000 | ₹90,000 |

| ₹50,000 | ₹1,00,000 | ₹1,50,000 |

| ₹1,00,000 | ₹2,00,000 | ₹3,00,000 |

Want a smarter estimate? Subtract big EMIs from your 2.5× base and then adjust ±20% for credit score. Example: ₹60k salary → 2.5× = ₹1.5L; minus ₹20k EMI ≈ ₹1.3L.

Note: Actual limits vary by issuer policy, credit score, existing debts, and income stability. Use responsibly.

Why Two People With the Same Salary Can Have Different Limits

1. Credit Score Matters

A high credit score (750+) tells banks you’re reliable and handle money well.

Example: Person A with a score of 780 might get a ₹1.5 lakh limit, while Person B with 690 may get only ₹1 lakh.

2. Existing Debts Reduce Your Limit

If you already have big loans or multiple credit cards, banks play safe.

Example: Two friends earn ₹50,000, but one has a ₹15,000 monthly EMI — their limit will likely be lower.

3. Job Type & Stability

Permanent jobs at reputable companies feel “safe” to banks compared to freelance or unstable work.

Example: An IT employee with a fixed salary may get more credit than a freelancer earning the same.

4. Past Payment History

Late payments are a red flag; consistent on-time payments build trust.

Example: Missing card payments twice in six months could reduce your offered limit.

5. Relationship With the Bank

Long-time, loyal customers often get automatic upgrades or better offers.

Example: Someone with 7 years of clean banking history may see higher limits than a new customer.

💡 In Short: Salary is just the starting point. Your score, debts, job, habits, and history with the bank all combine to decide your limit. That’s why two people earning ₹50,000 can have very different limits — ₹1 lakh vs ₹1.5 lakh — without it being unfair.

A More Realistic Way to Guess Your Limit

If you want a smarter estimate than the basic “×2 or ×3” rule, here’s a quick method you can try:

1. Start with 2.5 × your monthly salary

This gives you a middle-ground starting point.

2. Subtract your big monthly EMIs

Include loans, car payments, or any other fixed debts.

3. Adjust based on your credit score

Above 800: Add 10–20%

Between 700–800: No change

Below 700: Subtract 20–30%

Example Calculation:

Salary: ₹60,000 → 2.5× = ₹1,50,000 base limit

Loan EMI: ₹20,000 → New estimate = ₹1,30,000

Credit Score: 780 → No change

Estimated Limit: ₹1,30,000

💡 This method gives you a realistic ballpark number, though the final figure still depends on your bank’s internal policies.

Factors That Affect Credit Limit

| Factor | How It Helps ✅ | How It Hurts ❌ |

|---|---|---|

| Credit Score | 750+ shows strong trustworthiness → bigger limit | Below 700 signals higher risk → smaller limit |

| Existing Debts | Few or no loans = more room for credit | High EMIs eat into capacity → lower limit |

| Job Type & Stability | Permanent role in reputed company = stable profile | Freelance/unstable income = higher risk |

| Payment History | Always on-time payments build trust fast | Late/missed payments damage credibility |

| Bank Relationship | Long-term, clean history can trigger upgrades | New or poor history limits offers |

- Credit ScoreHow It Helps 750+ shows strong trustworthiness → bigger limitHow It Hurts Below 700 signals higher risk → smaller limit

- Existing DebtsHow It Helps Few or no loans = more room for creditHow It Hurts High EMIs eat into capacity → lower limit

- Job Type & StabilityHow It Helps Permanent role in reputed company = stable profileHow It Hurts Freelance/unstable income = higher risk

- Payment HistoryHow It Helps Always on-time payments build trust fastHow It Hurts Late/missed payments damage credibility

- Bank RelationshipHow It Helps Long-term, clean history can trigger upgradesHow It Hurts New or poor history limits offers

💡 Tip: These factors explain why two people earning the same salary can still get very different credit limits.

Things That Can Boost Your Credit Limit Over Time

Your starting limit isn’t set in stone. If you handle your card well, banks may happily increase it in just a few months. Here’s how you can make that happen:

1. Pay the Full Bill on Time

Always clear the entire bill, not just the minimum due. This builds trust with the bank and shows you can handle credit responsibly.

2. Keep Utilization Under 30%

If your limit is ₹1,00,000, try not to spend more than ₹30,000 regularly. Low utilization shows you’re not dependent on credit.

3. Update Your Income

Got a salary hike? Share the proof with your bank — higher income often leads to a higher limit.

4. Use the Card Regularly (But Smartly)

Active cards are more likely to get limit increases, but never spend more than you can pay off in full.

5. Maintain a Healthy Credit Mix

One credit card and a small loan is fine, but too many debts can hurt your chances of an increase.

💡 Consistency is key — a clean track record over 6–12 months can unlock a higher limit without you even asking.

Real Examples for Reference

Sometimes numbers make things easier to understand. Let’s look at three fictional people and see how their situations affect their credit limits:

1. Riya – New Job, ₹30,000 Salary

Credit Score: 740

No loans, but completely new to credit.

Likely Limit: Around ₹60,000 (about 2× her salary).

2. Arjun – ₹50,000 Salary, Long Bank History

Credit Score: 790

Has been with the same bank for over 7 years, with one car EMI of ₹10,000.

Likely Limit: Around ₹1,20,000.

3. Neha – ₹80,000 Salary, High Utilization on Other Cards

Credit Score: 710

Already holds 2 credit cards with a combined ₹2 lakh limit.

Likely Limit: About ₹1,00,000, despite her higher income, because of existing credit usage.

💡 The takeaway? Your credit limit isn’t just about income — it’s the whole financial picture that counts.

Adjusted Limit Calculation Table (Based on Credit Score & EMIs)

| Monthly Salary | Base Limit (2.5×) | EMI Deduction | Credit Score Adjustment | Final Estimated Limit |

|---|---|---|---|---|

| ₹60,000 | ₹1,50,000 | ₹20,000 | 780 (No Change) | ₹1,30,000 |

| ₹50,000 | ₹1,25,000 | ₹15,000 | 820 (+15%) | ₹1,27,500 |

| ₹80,000 | ₹2,00,000 | ₹0 | 690 (−25%) | ₹1,50,000 |

- Monthly Salary ₹60,000Base Limit (2.5×)₹1,50,000EMI Deduction₹20,000Credit Score Adj.780 (No Change)Final Estimated Limit₹1,30,000

- Monthly Salary ₹50,000Base Limit (2.5×)₹1,25,000EMI Deduction₹15,000Credit Score Adj.820 (+15%)Final Estimated Limit₹1,27,500

- Monthly Salary ₹80,000Base Limit (2.5×)₹2,00,000EMI Deduction₹0Credit Score Adj.690 (−25%)Final Estimated Limit₹1,50,000

💡 Shows a realistic calculation beyond the simple multiplier.

Myths People Believe (and the Truth)

Myth 1: “If I earn more, I’ll automatically get a huge limit.”

Truth: A bigger income helps, but banks care just as much — if not more — about how you spend and repay. A high earner with poor repayment habits can still get a lower limit than someone earning less but managing credit well.

Myth 2: “Asking for a limit increase will hurt my credit score.”

Truth: If you make the request occasionally and have a solid payment history, it won’t damage your score. In fact, a higher limit can improve your credit utilization ratio, which can boost your score over time.

Myth 3: “All banks calculate the same way.”

Truth: Every bank has its own unique formula. Two people with identical profiles could still get very different limits depending on the bank they apply to.

💡 Moral of the story: Don’t rely on assumptions — understand the factors and work on the ones you can control.

When to Ask for a Higher Limit

Timing matters when it comes to requesting a credit limit increase. You’ll have the best shot if you ask when your profile looks its strongest:

1. After 6–12 Months of Perfect Repayments

Consistently paying your bills in full and on time shows the bank you’re responsible with credit.

2. When Your Income Has Officially Increased

Got a salary hike or new job with higher pay? Provide proof — higher income often justifies a bigger limit.

3. If You’ve Kept Utilization Low

Regularly using only a small portion of your current limit tells the bank you’re not dependent on credit.

💡 Pro Tip: Even if you don’t need more credit right now, a higher limit can help your credit score by lowering your credit utilization ratio — a key factor in scoring models.

Your salary might set the base for your credit card limit in India, but it’s far from the full recipe. Think of it like baking a cake — salary is the flour, but your credit score, existing debts, job stability, and repayment habits are the sugar, butter, and icing that make it complete.

If you’re aiming for the highest limit possible:

Keep your credit score strong — above 750 is ideal.

Pay your bills in full and on time — never just the minimum.

Update your bank whenever your income increases.

A little discipline today can mean a higher limit tomorrow — giving you more flexibility, better credit health, and extra breathing room when you need it most.

Frequently Asked Questions

Q1: How is credit card limit calculated based on salary in India?

Many issuers start with a multiplier of roughly 2×–3× of your monthly in-hand salary, then adjust for credit score, existing EMIs, repayment history, job stability, and internal policies.

Q2: What is a realistic way to estimate my credit card limit?

Use 2.5 × monthly salary as a base, subtract large monthly EMIs, then adjust for credit score:

Add 10–20% if your score is 800+

No change for 700–800

Subtract 20–30% if below 700

Q3: Why do two people with the same salary get different limits?

Because issuers also weigh credit score, current debts, credit utilisation, payment history, job type, and your relationship with the bank — not just income.

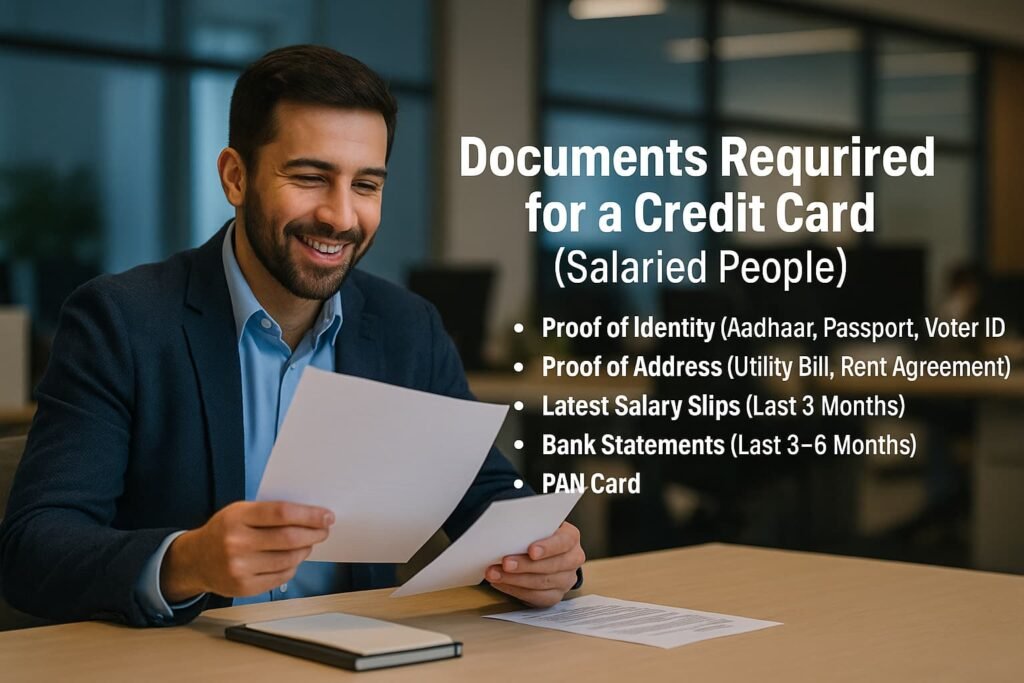

Q4: What documents are required for a salaried person to get a credit card?

Common documents include:

PAN Card

Aadhaar/Passport/Voter ID (identity proof)

Recent utility bill or rent agreement (address proof)

Last 3 months’ salary slips

Last 3–6 months’ bank statements

Q5: What is a good credit utilisation ratio?

Staying under 30% of your total limit is ideal. For a ₹1,00,000 limit, try to keep monthly outstanding below ₹30,000.

Q6: How can I increase my credit card limit over time?

Pay bills in full and on time, keep utilisation under 30%, use the card regularly but responsibly, update income after a hike, and request a review after 6–12 months of good behaviour.

Q7: Does asking for a higher limit hurt my credit score?

Occasional requests with a good repayment record typically don’t harm your score. A higher limit may even improve your utilisation ratio.

Q8: What minimum salary is needed for a credit card in India?

It varies by issuer and card type — entry-level cards may start around ₹15,000–₹25,000 monthly income, while premium cards require significantly higher and stronger credit profiles.

Q9: Does my employer or job type affect the limit?

Yes. Permanent roles at reputed organisations are seen as lower risk than temporary or irregular income, which can influence the approved limit.

Q10: If my salary increases, when will my limit update?

Inform the bank and submit new proof. Many issuers review within a few working days and may offer a revised limit if your profile supports it.

Q11: Can I hold multiple credit cards and still get a high limit?

Yes, as long as your total utilisation is low, EMIs are manageable, and you maintain on-time payments.

Q12: Will a higher limit improve my credit score?

Indirectly, yes — a higher limit can lower your utilisation percentage, which usually helps scores.

Q13: Is there a universal formula for credit card limits?

No. Each bank has its own method, so treat any calculator as an estimate.

About Seva Funds & Important Disclosures

About the Author

Prashant SN

Education: MCom (Master of Commerce)

What I enjoy: Finance calculations and building easy tools for everyday decisions

Hi, I am Prashant SN. I studied MCom and I am interested in finance calculation. I started Seva Funds to share clean, fast calculators and no-nonsense explanations for India.

Disclaimer

This website and its content are for informational and educational purposes only. It is not intended to be and does not constitute financial, legal, or any other type of professional advice. We do not guarantee the accuracy, completeness, or usefulness of any information on the site. Always consult with a qualified financial professional before making any financial decisions.

🔗 More From SevaFunds

- Early Retirement Feasibility in India Assumptions, inflation, safe withdrawal rate, and planning checklist.

- GST-Inclusive Price Breakdown Split “price including GST” into base + GST with formulas & examples.

- Calculate Credit Card Limit Based on Salary (India) Bank multipliers, income proofs, utilization tips, and upgrade strategies.