Early retirement feasibility in India is all about figuring out whether your current savings, future investments, and expected returns can sustain your lifestyle for decades after you stop working. With rising life expectancy, changing career paths, and the growing popularity of the FIRE movement (Financial Independence, Retire Early), more Indians are asking: Can I afford to retire before 60?

This guide breaks down what early retirement feasibility means, the unique Indian factors you must consider, and how to run a simple calculation to check if you’re on track.

Impact of Retirement Age on Required Corpus

| Retirement Age | Years in Retirement | Annual Expense at Retirement | Required Corpus |

|---|---|---|---|

| 45 | 40 | ₹15 lakh | ₹4.7 crore |

| 50 | 35 | ₹15 lakh | ₹4.2 crore |

| 55 | 30 | ₹15 lakh | ₹3.6 crore |

What Is Early Retirement Feasibility?

Early retirement feasibility means assessing whether your accumulated wealth can cover your expenses for the rest of your life, adjusted for inflation, without relying on active income. It’s not just about having a “big number” in the bank — it’s about ensuring your assets generate enough income to keep up with rising costs over time.

In India, early retirement planning requires factoring in:

Inflation that often runs higher than in developed countries.

Local investment options and tax rules.

Cultural and family responsibilities that may add financial obligations.

Why It Matters More in India

India’s financial environment has its own set of challenges and opportunities:

Inflation

Over the last decade, average inflation has been around 5–6%, with healthcare and education often rising faster. This means your expenses could double in 12–14 years.Investment Landscape

Common tools include the National Pension System (NPS), Public Provident Fund (PPF), Employees’ Provident Fund (EPF), equity mutual funds, fixed deposits, and real estate. Each comes with different returns, liquidity, and tax treatment.Tax Rules

Long-term capital gains (LTCG) on equity above ₹1 lakh/year are taxed at 10%.

PPF maturity is fully tax-free.

NPS requires partial annuitization, which impacts flexibility.

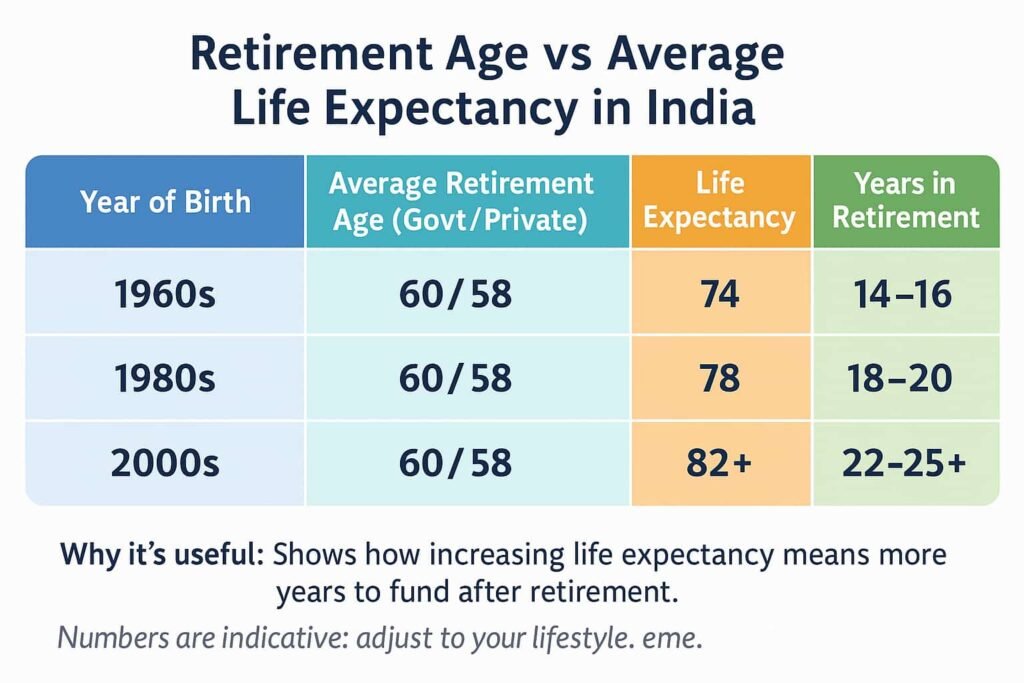

Longevity

Life expectancy is rising, meaning a retirement of 35–40 years isn’t unusual for those who retire early.

Common Sources of Retirement Income in India

| Source | Risk Level | Liquidity | Tax Treatment |

|---|---|---|---|

| NPS | Medium | Low | Partial tax benefit, annuity taxable |

| PPF | Low | Low | Fully tax‑free maturity |

| EPF | Low | Medium | Tax‑free if 5+ years |

| Equity Mutual Funds (SIP) | High | High | 10% LTCG above ₹1 lakh |

| Rental Income | Medium | Medium | Taxable under “Income from House Property” |

| Bank Fixed Deposits | Low | High | Interest fully taxable |

Step-by-Step Calculation Example

Let’s run a basic example to illustrate early retirement feasibility in India.

Scenario:

Current age: 35

Target retirement age: 50

Current monthly expenses: ₹60,000 (today’s value)

Inflation: 5%

Post-retirement return: 7%

Life expectancy: 85 years

Step 1: Adjust Expenses for Inflation

Expenses at 50 = ₹60,000 × (1 + 0.05)¹⁵ ≈ ₹1,25,000/month

That’s ₹15 lakh/year in retirement’s first year.

Step 2: Calculate Required Corpus

If you expect a 7% post-retirement return and 5% inflation, your real return is ~2%. Using a growing annuity formula for 35 years of retirement:

Required Corpus ≈ ₹4.2 crore

Step 3: Compare With Your Projected Corpus

Estimate your savings growth until age 50 using your current investments and contributions. If your projection is below ₹4.2 crore, there’s a feasibility gap.

Ways to Improve Your Early Retirement Feasibility

If your calculation shows a gap, don’t panic. Small adjustments can make a big difference.

Increase Monthly Investments

Even ₹5,000 extra per month can compound into lakhs over time.

Delay Retirement

Working just 2–3 extra years increases your corpus and shortens your retirement duration.

Reduce Expenses

Every ₹1,000/month saved reduces your required corpus significantly.

Diversify Investments

Balance growth (equities) and safety (debt funds, fixed deposits) to manage risk.

Plan Withdrawals Tax-Efficiently

Draw from the most tax-advantaged accounts first to make your money last longer.

Risks to Watch Out For

Early retirement in India is achievable, but it’s not risk-free.

Sequence of Returns Risk: Poor market returns early in retirement can deplete your corpus faster.

Higher Inflation: If inflation exceeds your assumption, expenses rise faster than planned.

Unexpected Expenses: Medical emergencies or family obligations can derail plans.

Policy Changes: Tax or investment rule changes can impact returns or withdrawals.

Mitigating these risks involves using conservative estimates, keeping a cash buffer, and reviewing your plan annually.

Major Retirement Expenses in India

| Expense Category | % of Retirement Budget | Notes |

|---|---|---|

| 🏠 Housing (rent/maintenance) | 15–25% | Even if owned, maintenance charges apply. |

| 🥗 Food & Groceries | 10–15% | Rises with lifestyle choices. |

| 🩺 Healthcare | 20–30% | Biggest inflation risk area. |

| ✈️ Travel & Leisure | 10–15% | Often higher in early retirement years. |

| 🔌 Utilities & Services | 5–10% | Internet, phone, electricity. |

| 🎁 Gifts & Social Obligations | 5–10% | Weddings, festivals, family support. |

The Indian Context and FIRE

The FIRE movement, popular in the US, focuses on saving and investing aggressively to retire early. In India, adapting FIRE means accounting for:

Higher inflation.

Cultural spending patterns (e.g., family functions, education for children).

Fewer low-cost index fund options compared to the US, though they are growing.

Many Indian early retirees aim for a more flexible model — semi-retirement or part-time work to reduce drawdowns in the early years.

Early retirement feasibility in India depends on realistic calculations, disciplined investing, and flexibility in your plans. The sooner you start planning, the more time compounding has to work in your favor.

Even if your current numbers don’t match your target, adjustments in spending, investing, and retirement age can help you close the gap. Most importantly, revisit your plan regularly to account for changes in inflation, returns, and your personal life.

If you want a quick way to check your numbers, you can use an Early Retirement Feasibility Calculator designed for Indian conditions — but remember, the calculator is just a tool. The real success comes from understanding the numbers and making informed choices year after year.

About Seva Funds & Important Disclosures

About the Author

Prashant SN

Education: MCom (Master of Commerce)

What I enjoy: Finance calculations and building easy tools for everyday decisions

Hi, I am Prashant SN. I studied MCom and I am interested in finance calculation. I started Seva Funds to share clean, fast calculators and no-nonsense explanations for India.

Disclaimer

This website and its content are for informational and educational purposes only. It is not intended to be and does not constitute financial, legal, or any other type of professional advice. We do not guarantee the accuracy, completeness, or usefulness of any information on the site. Always consult with a qualified financial professional before making any financial decisions.

🔗 More From SevaFunds

- Petrol Tax in India: Monthly & Yearly Cost (2025) Breakup of base price, excise, VAT, dealer commission with simple examples.

- Side Income in India for Financial Independence Low-cost side hustles, skill ideas, and compounding math to speed up FI.

- Superannuation Withdrawal Rules (India) Tax treatment, partial/ full withdrawal rules, and when to opt for annuity.