If you’ve ever stood at a shop counter, looked at your bill, and wondered, “Why is there an extra tax here?”, you’re not alone. That “extra” is often GST — Goods and Services Tax.

This GST calculation guide isn’t just about crunching numbers. It’s about helping everyday people understand why GST exists, how it affects prices, and what small things you can do to be smarter with your money. Think of it as that friendly neighbor who explains complicated things over a cup of chai — simple, clear, and without government-style headaches.

GST has been part of our lives in India since 1st July 2017, replacing many other indirect taxes like VAT, service tax, excise duty, and more. The promise was “One Nation, One Tax”, making the tax process cleaner and easier for both businesses and customers. But for many people, GST still feels like a mystery. So, let’s break it down — step by step — and see how it really works in your daily life, from your grocery bill to your online shopping cart.

What is GST? (What Every Common Man Should Know)

GST — Goods and Services Tax — is like an umbrella tax. You pay it on almost every product or service you buy or use, and the government uses this money to fund public needs like roads, hospitals, schools, railways, and more.

Before GST, life was more complicated. There were multiple taxes at different stages — one when goods were manufactured, another when they were sold, another when services were provided. This meant more paperwork, more confusion, and often, a “tax on tax” situation.

GST replaced all that with one unified system, so whether you buy a pair of shoes in Delhi or order them from Mumbai, the tax system works the same way. That’s why people call it “One Nation, One Tax.”

Quick facts for your GST calculation guide:

Launched: 1 July 2017

Aim: Simplify taxes and make them uniform across India

Types of GST:

CGST – Central GST (collected by the central government)

SGST – State GST (collected by the state government)

IGST – Integrated GST (applied on interstate trade between states)

A simple example:

Imagine you buy a mobile phone worth ₹10,000 in your city. You’ll pay CGST + SGST since it’s within the same state. But if you buy it online from another state, IGST will apply instead. Either way, the total GST is calculated in a transparent, standard way.

GST Rate Slabs (India)

| GST Rate | Examples | Common Use Case |

|---|---|---|

| 0% | Fresh fruits, milk, wheat | Basic daily essentials Keeps staple foods affordable |

| 5% | Train tickets, edible oil, sugar | Affordable travel & groceries Small impact on routine spends |

| 12% | Mobile phones, processed food | Moderate spending items Common monthly purchases |

| 18% | Electronics, AC restaurants | Common lifestyle products Most services fall here |

| 28% | Luxury cars, cigarettes | Luxury & “sin” goods Designed to discourage use |

Why Do We Need GST?

Many people think GST is just another way for the government to take our money — but it’s more than that. In fact, if you look closely, GST has solved a lot of headaches from the old tax system.

Here’s why this GST calculation guide is worth your time:

📝 Simplifies Taxes – Earlier, buying a product meant you might pay VAT, excise duty, entry tax, and service tax — sometimes all at once. Now, you see just GST on the bill. It’s cleaner and easier to understand.

🚫 Reduces Double Taxation – Before GST, you could be charged a tax on top of another tax. For example, service tax applied on a restaurant bill after VAT was already added to the food. That “tax on tax” inflated prices. GST fixed that.

⚖️ Uniform Rates Across India – Earlier, a shirt could be taxed differently in Gujarat and Maharashtra. Now, GST ensures the rate is the same everywhere. So you don’t pay more just because you shop in another state.

🔍 Boosts Transparency – Bills now clearly show how much GST you paid. You can check the rate, calculate the amount, and see exactly where your money went. No more “mystery charges” hidden in the final price.

Real-life example:

Imagine you’re traveling from Delhi to Jaipur and you buy the same packet of biscuits in both cities. Before GST, the price could vary because of different state taxes. Now, with GST, the tax percentage stays the same, and so does the final cost (unless shopkeepers try to sneak in extra charges — which you can now spot easily).

GST Rates in India (How These % Affect a Common Man’s Life)

Not everything you buy is taxed at the same rate. The GST Council — a group of government officials who meet every few months — decides what falls under which tax slab. These slabs are like “buckets” where products are grouped based on how essential or luxury they are.

Here’s a clear look at GST rates:

| GST Rate | Examples | How It Affects You |

|---|---|---|

| 0% | Milk, wheat, fresh fruits | Keeps essential food items affordable for all. |

| 5% | Edible oil, sugar, rail tickets | A small, manageable tax on daily needs and public travel. |

| 12% | Processed food, cell phones | Slightly higher, often felt in monthly budgets. |

| 18% | Electronics, most services, clothes above ₹1,000 | Affects middle-class spending on non-essential but common items. |

| 28% | High-end cars, cigarettes | Targets luxury and “sin” goods, mostly impacting those with higher incomes. |

(Rates correct as of August 2025, but the GST Council may update them.)

Why these rates matter to a common man:

Your grocery bill: Fresh fruits are tax-free, but biscuits or packaged snacks fall under 5% or 12%.

Your travel cost: Rail tickets have a small 5% GST, but flight tickets can have higher rates.

Your shopping budget: That ₹999 shirt stays under 5% GST, but at ₹1,001 it jumps to 18%.

Your entertainment: Movie tickets under ₹100 have 12% GST, while premium tickets have 18%.

Example from real life:

Ravi, a college student, noticed his train ticket from Lucknow to Delhi had only ₹18 GST for a ₹360 fare (5% slab). But when he booked a last-minute flight instead, GST alone added ₹600 to his ticket price. Same journey — but the GST rate made a big difference to his pocket.

How to Calculate GST — The Easy Way

Don’t worry — you don’t need to be a math genius to figure out GST. It’s just basic multiplication and subtraction once you know whether the price is with GST (inclusive) or without GST (exclusive).

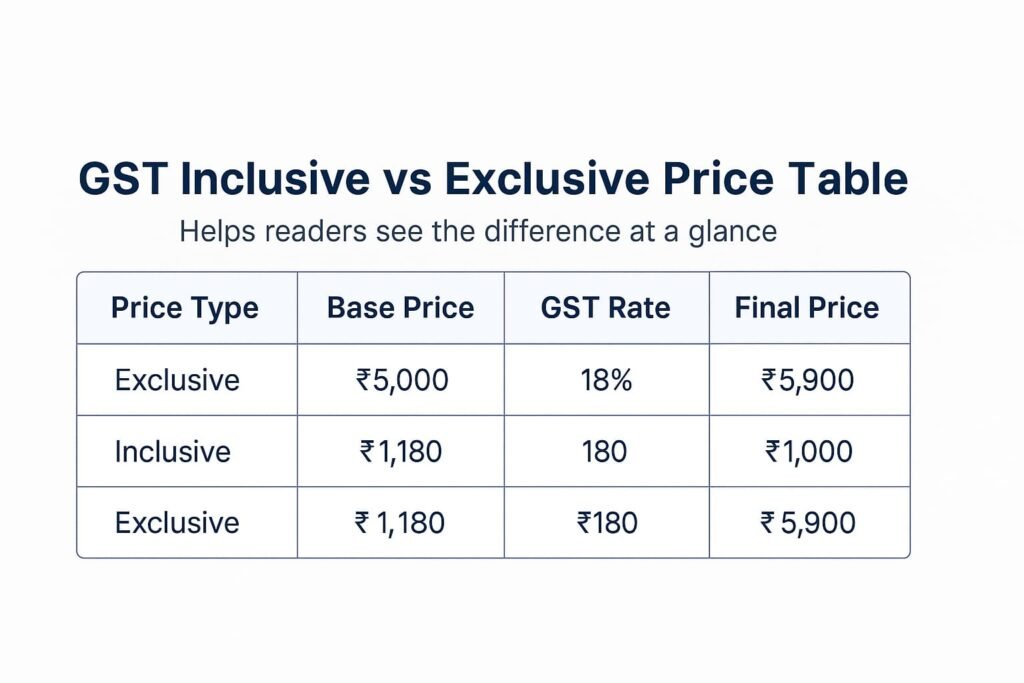

1. Exclusive of GST

This means GST is added on top of the price.

Steps:

Take the original price.

Multiply it by the GST rate.

Add that amount to the original price — that’s your final price.

Example:

You buy a mixer grinder for ₹5,000, GST rate is 18%.

GST = ₹5,000 × 18% = ₹900

Final Price = ₹5,000 + ₹900 = ₹5,900

2. Inclusive of GST

This means the GST is already included in the price shown.

Steps:

Take the total price.

Use this formula:

GST Amount = Price × (GST% ÷ (100 + GST%))Subtract the GST amount from the total to get the base price.

Example:

A shirt is marked ₹1,180, GST rate is 18%.

GST Amount = ₹1,180 × (18 ÷ 118) = ₹180

Original Price = ₹1,180 – ₹180 = ₹1,000

💡 Tip: If math isn’t your cup of tea, you can use any free “GST calculator” app or website. Just type in the price and GST rate, and it’ll do the work for you.

Common GST Rates for Everyday Life

| Category | GST Rate | Example |

|---|---|---|

| Eating at small non‑AC restaurant | 5% | Local dhaba bill ₹200 → ₹210 total |

| Online food delivery | 5% | Swiggy order ₹500 → ₹525 total |

| Domestic economy flight | 5% | Ticket ₹3,000 → ₹3,150 total |

| AC dine‑in restaurant | 18% | Dinner ₹1,000 → ₹1,180 total |

Common Mistakes People Make with GST

Even with this GST calculation guide in hand, it’s easy to slip up. Here are the most common goof-ups — and how to avoid them:

❌ Not Checking the GST Rate

Some shops (especially smaller ones) might apply the wrong GST rate — either by mistake or to charge extra.

✅ Fix: Quickly check the GST slab for the product on Google or the official GST website.❌ Confusing MRP and Price

Remember: MRP already includes GST. If you’re charged GST on top of MRP, you’re paying extra.

✅ Fix: If the product has MRP printed, you should only pay that — nothing more.❌ Forgetting GST in Services

In restaurants, salons, or repair shops, GST is often added separately to the bill.

✅ Fix: Check your bill breakdown so you know if GST is already included or added later.

Quick example:

Anita went to a salon for a ₹500 haircut. The bill showed ₹500 + 18% GST = ₹590. That’s fine because the original price didn’t include GST. But when she bought shampoo with ₹200 MRP and was still charged GST extra, she knew something was wrong — and saved ₹36 by pointing it out.

How GST Affects You Every Day

It’s easy to think GST only comes into play when you buy a fridge or a bike. But the truth is — it’s everywhere, quietly adding to the price of things you use daily.

Here’s how it shows up in your routine:

🛒 Groceries

Fresh fruits and vegetables? 0% GST.

Packaged biscuits or ready-to-cook noodles? Usually 5% or 12% GST.

That’s why a packet of Maggi costs a little more than just the raw ingredients — part of it is GST.

🚆 Travel

Train tickets have a small 5% GST.

Flights? 5–12% GST depending on the class.

It may seem tiny, but frequent travellers feel it in their budget.

🍽️ Restaurants

Small non-AC eateries: 5% GST.

AC restaurants or those serving alcohol: 18% GST.

So, your ₹1,000 dinner in an AC restaurant will have ₹180 tax added.

📦 Online Shopping

Amazon, Flipkart, Myntra — prices usually include GST already.

The GST amount is shown on the invoice so you know exactly how much went to tax.

Real-life snapshot:

Ravi buys train tickets twice a week for ₹400 each. With 5% GST, that’s ₹20 extra per ticket — ₹160 per month. Now add in the GST he pays on phone recharges, movie tickets, and weekend dinners, and it’s easy to see how small amounts add up over time.

Small GST Hacks for the Common Man

A little awareness can save you money (and arguments at the counter). Here are some smart GST habits to pick up:

🧾 Always Check the Bill

Make sure the GST rate matches the product’s official slab. If a shop charges 18% GST on something that’s in the 5% category, you’re paying extra.📱 Use GST Calculator Apps

No need to do math in your head. Just type the price and GST rate into a free app or website — it’ll instantly tell you the GST amount and total price.🏪 For Small Business Owners

If you sell goods or services, learn about Input Tax Credit (ITC). It lets you deduct the GST you’ve already paid on purchases from the GST you collect from customers — lowering your tax bill.📚 Keep Old Bills for Reference

This helps you track price changes and GST rates over time, especially for big-ticket items like electronics or appliances.

Example:

Meena spotted that her local store charged 12% GST on a product that should have been 5%. She politely pointed it out and got a corrected bill — saving ₹35 instantly. Small checks, big savings over a year.

GST Impact Before vs After 2017

| Before GST | After GST |

|---|---|

| VAT, Excise Duty, Service Tax applied separately | Single GST rate |

| “Tax on Tax” common | No double taxation |

| Rates varied by state | Uniform rates across India |

A Real-Life Story

Meet Ramesh, a small shop owner in Jaipur. Before GST, his life was a maze of different taxes — VAT on goods, service tax on certain services, and excise duty on some items. Each came with its own rules, forms, and payment deadlines.

Every month, Ramesh would spend hours with his accountant, sorting through bills, calculating separate taxes, and making multiple payments. It was confusing, stressful, and sometimes costly if he missed a deadline.

Then GST arrived in July 2017. Suddenly, instead of juggling three or four taxes, there was just one to track. His accountant no longer had to prepare different returns for different taxes, and Ramesh could see exactly how much GST he collected and paid.

The change didn’t just save him paperwork — it gave him peace of mind. Now, Ramesh spends more time running his shop, talking to customers, and expanding his product range, instead of drowning in tax files.

Ramesh’s takeaway:

“I won’t say I love paying tax, but at least now I understand it — and that’s a big relief.”

Final Word — Don’t Fear GST

GST isn’t here to trick you — it’s simply the government’s way of collecting taxes in a cleaner, more transparent system. Once you understand the basics and know how to calculate it, GST stops being a mystery and starts feeling like just another part of everyday life.

The next time you look at a bill and see that extra line with “GST,” you won’t be asking, “Yeh extra charge kya hai?” — you’ll already know the answer, and maybe even double-check if it’s correct.

Remember:

Awareness is power — knowing the GST rate and how it’s calculated can save you money.

Small checks add up — catching wrong GST charges even once a month can save you hundreds over a year.

Confidence replaces confusion — when you know your rights and the rules, nobody can overcharge you easily.

So, treat this GST calculation guide like your pocket-friendly tax buddy — here to make your shopping, dining, and travel a little more transparent and a lot less confusing.

FAQ (for readers)

1) What is GST in simple words?

GST is a single tax charged on goods and services you buy. It replaced many old taxes like VAT and service tax.

2) Do I pay GST on everything?

No. Essentials like fresh fruits and milk are 0%. Many daily items are 5% or 12%, services are often 18%, and luxury/sin goods can be 28%.

3) Does MRP include GST?

Yes. MRP is the maximum retail price including GST. Shops shouldn’t add GST on top of MRP.

4) What’s the difference between CGST, SGST and IGST?

For purchases within the same state, tax splits as CGST (centre) + SGST (state). For interstate purchases, IGST applies.

5) How do I calculate GST if the price is without tax (exclusive)?

GST Amount = Price × (GST% ÷ 100).

Final Price = Price + GST Amount.

6) How do I find the GST part if the price already includes tax (inclusive)?

GST Amount = Total Price × (GST% ÷ (100 + GST%)).

Base Price = Total Price − GST Amount.

7) Why do restaurant bills sometimes show 5% and sometimes 18%?

Small/non-AC eateries generally charge 5%. Many dine‑in restaurants and those serving alcohol charge 18%.

8) Are train and flight tickets taxed under GST?

Yes. Train tickets have 5% GST; flights usually fall between 5–12% depending on class/category.

9) Can a shop charge GST without a GSTIN?

No. If GST is charged, the invoice should display a valid GSTIN. Always check it on the bill.

10) I’m a small business owner—how does ITC help me?

Input Tax Credit (ITC) lets you reduce your GST payable by the GST you’ve already paid on business purchases (subject to eligibility and compliance).

About Seva Funds & Important Disclosures

About the Author

Prashant SN

Education: MCom (Master of Commerce)

What I enjoy: Finance calculations and building easy tools for everyday decisions

Hi, I am Prashant SN. I studied MCom and I am interested in finance calculation. I started Seva Funds to share clean, fast calculators and no-nonsense explanations for India.

Disclaimer

This website and its content are for informational and educational purposes only. It is not intended to be and does not constitute financial, legal, or any other type of professional advice. We do not guarantee the accuracy, completeness, or usefulness of any information on the site. Always consult with a qualified financial professional before making any financial decisions.

🔗 More From SevaFunds

- EV vs Petrol Cars for Daily Commute Per-km cost, maintenance, charging vs fuel math, and payback period.

- Is Household Income Monthly or Yearly? What forms, loans, and schemes mean—plus quick conversion tips.

- GST Calculation Guide for the Common Man Item price → GST → final bill with slabs, formulas, and examples.