Tax Guides for India

Understand income tax, GST, and everyday tax decisions with plain-language explainers and worked examples.

From creator income and temporary jobs to senior citizen exemptions and GST maths on purchases, these guides help you calculate the right amount, avoid common mistakes, and stay compliant without jargon.

Tax Highlights — Clear & Practical

Creator income, temporary jobs, senior benefits, GST maths, property scenarios, and fuel taxes—explained in simple steps.

YouTube Income: Tax Calculation (India)

Heads of income, allowable expenses, and step-by-step tax math tailored for creators.

Temporary Jobs: How Your Income is Taxed

TDS situations, what counts as income, and simple examples for short-term work.

Senior Citizens: Key Exemptions & Reliefs

Interest income relief, medical deductions, and practical filing notes.

GST Basics: Everyday Calculation Guide

Inclusive vs exclusive pricing, slab intuition, and quick back-of-the-envelope maths.

Property Purchase: When GST Applies

Effective rates, affordable vs standard housing, and simple buyer scenarios.

GST-Inclusive Price: Split into Base + GST

Tiny formulas to reverse-calculate base value and tax from an MRP.

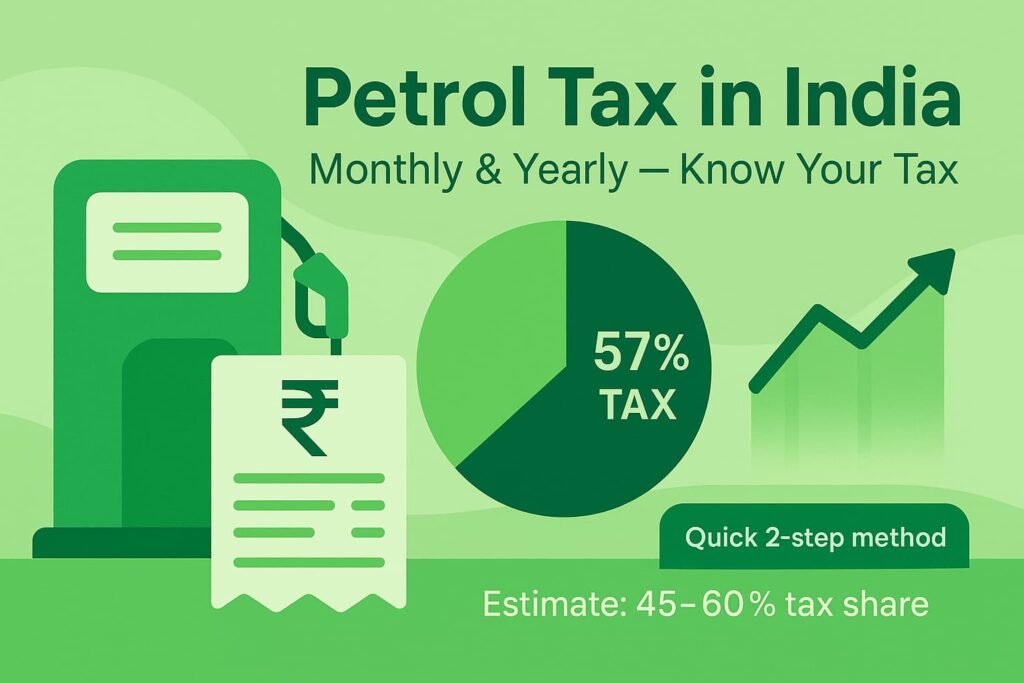

Petrol Tax: Monthly & Yearly Impact

See how tax components shape pump price and your monthly commute budget.

Income Tax & GST — Quick Primer

A compact, plain-English overview for Indian readers. Understand how income tax and GST work, with simple points and quick maths—right on this page.

i Income Tax: Basics & Regimes

Income tax is calculated on your taxable income for the year. India offers two approaches—an old regime (with popular deductions) and a new regime (simpler slabs, fewer deductions). Choose what fits your situation after comparing totals.

- Old regime: Allows common deductions (e.g., investments/insurance/medical) but has more calculation steps.

- New regime: Lower/simpler slab rates for many; fewer deductions to claim, quicker to compute.

- TDS & advance tax: Tax may be collected throughout the year via employer/client TDS or your own advance tax payments.

- Seasonal checks: Keep Form 16/26AS, interest statements, and proofs handy for accurate filing.

% GST: Basics & Quick Maths

GST is a consumption tax added to most goods/services. Prices may be shown as exclusive (GST added on top) or inclusive (GST already inside). A few quick formulas help you estimate the split without tools.

- Exclusive price → Total: Total = Base × (1 + GST%).

- Inclusive price → Base: Base = Inclusive ÷ (1 + GST%).

- Inclusive price → GST part: GST = Inclusive − Base.

- Common use-cases: everyday purchases, invoices, and big-ticket items like under-construction property (where applicable).

Tax Guides — Page & Navigation FAQs

This Tax Guides page brings together our income tax and GST explainers. These FAQs clarify what we cover and how to use this menu effectively.

› What topics are covered on this page?

India-focused explainers on income tax (creator income, temporary jobs, senior citizen benefits) and GST (inclusive/exclusive price maths, property GST basics), plus practical examples like fuel tax impact.

› Is the content India-specific and which FY/AY does it use?

Yes—our guides are written for Indian rules and practice. Each article states the financial year/assessment year or notes when numbers are illustrative, and we update key pages when regulations change.

› How is this page different from Money Guides or Credit Guides?

Tax Guides covers income tax and GST rules and calculations. Money Guides explains savings/returns and everyday money choices. Credit Guides focuses on CIBIL, credit cards, and loans. Use all three for a full picture.

› Do you provide personalised tax advice or filing services?

No. Our content is educational with worked examples to help you understand the method. For personal advice or filing, consult a qualified professional.

› Do you have tax calculators?

We currently focus on clear explanations and step-by-step maths inside each article. This keeps the method transparent and easy to verify.

› Will state-wise rates (like fuel taxes) match exactly?

We explain the structure and give sample scenarios. Some components vary by state and over time, so always verify current rates from official notices if you need exact figures.

› How do I navigate the menu and find related topics?

Start with the stacked cards above for core tax guides. For broader money topics, visit Money Guides; for loans/cards, see Credit Guides; for benefits and eligibility, check Government Schemes.

› Can I request a topic or report a correction?

Yes. Email us at sevafundsofficial@gmail.com with the page URL and details. We prioritise clarity and fix verified issues promptly.