Income tax for temporary jobs doesn’t have to be confusing. Temporary work can be a lifesaver—maybe you helped at a festival stall, took a short freelance project, or did a few weekend delivery shifts. When filing time comes, the obvious doubt pops up: Do I need to pay tax on that money?

Yes—if you earn it, it’s taxable in India. The twist is that temp earnings get added to your total yearly income and then taxed as per your chosen regime (old or new). No fancy jargon here: you total up what you made, subtract eligible deductions (if you’re using the old regime), and apply the slab rates. In this guide, we’ll walk through the steps, show a simple example, and flag common mistakes—so you know exactly what to set aside and never get a surprise at filing time.

What Counts as a Temporary Job?

A temporary job isn’t just about how long you work — it’s about how you’re employed. These roles are usually short-term, seasonal, or project-based, and they often skip the usual full-time perks like paid leave, medical insurance, or retirement benefits.

You might be:

Hired for a few weeks to help in a store during festive shopping rush.

Working as a substitute teacher while the regular teacher is on leave.

Taking on freelance gigs from home — like graphic design, writing, or coding.

Helping at an event for a day or two, such as concerts, fairs, or exhibitions.

Joining seasonal work like harvest picking, summer camps, or holiday package delivery.

Why this matters for tax:

Even if your job lasts just a day, your payment counts as income.

The form of payment — cash, bank transfer, cheque, or even gift vouchers — doesn’t matter to tax authorities.

Some employers don’t deduct tax for temporary workers, so you may need to handle it yourself when filing.

Quick tip: Keep a record of every payment, even if it feels small. Temporary earnings have a way of adding up faster than you expect, and they can push you into a higher tax bracket.

Common Allowable Deductions (Old Regime)

Popular deductions frequently used by salaried taxpayers under the old tax regime in India.

| Section | Deduction Type | Limit (₹) |

|---|---|---|

| 80C | Investments (PPF, ELSS, EPF, NSC, Life Insurance, principal on home loan, etc.) | 1,50,000 |

| 80D | Health Insurance Premium (self/family & parents) | 25,000 / 50,000 (senior citizens) |

| 80TTA | Savings Bank Interest (non-senior citizens) | 10,000 |

| 80TTB | Bank/Post Office Interest (senior citizens) | 50,000 |

Note: Section 80C has an overall cap of ₹1.5 lakh (combined). Section 80D limits vary by age and who is insured. 80TTA and 80TTB cannot be claimed together—80TTB applies only to senior citizens.

Step-by-Step: How to Calculate Income Tax on Temporary Jobs in India

Here’s the simple way to do it under the new tax regime for FY 2024–25:

Step 1: Add up all your temporary job earnings

Include every payment you received for short-term work — whether by cash, bank transfer, UPI, cheque, or gift card.

Step 2: Combine with other income

If you also have a main salary or other sources of income (like rent or interest), add your temporary job income to your total annual income.

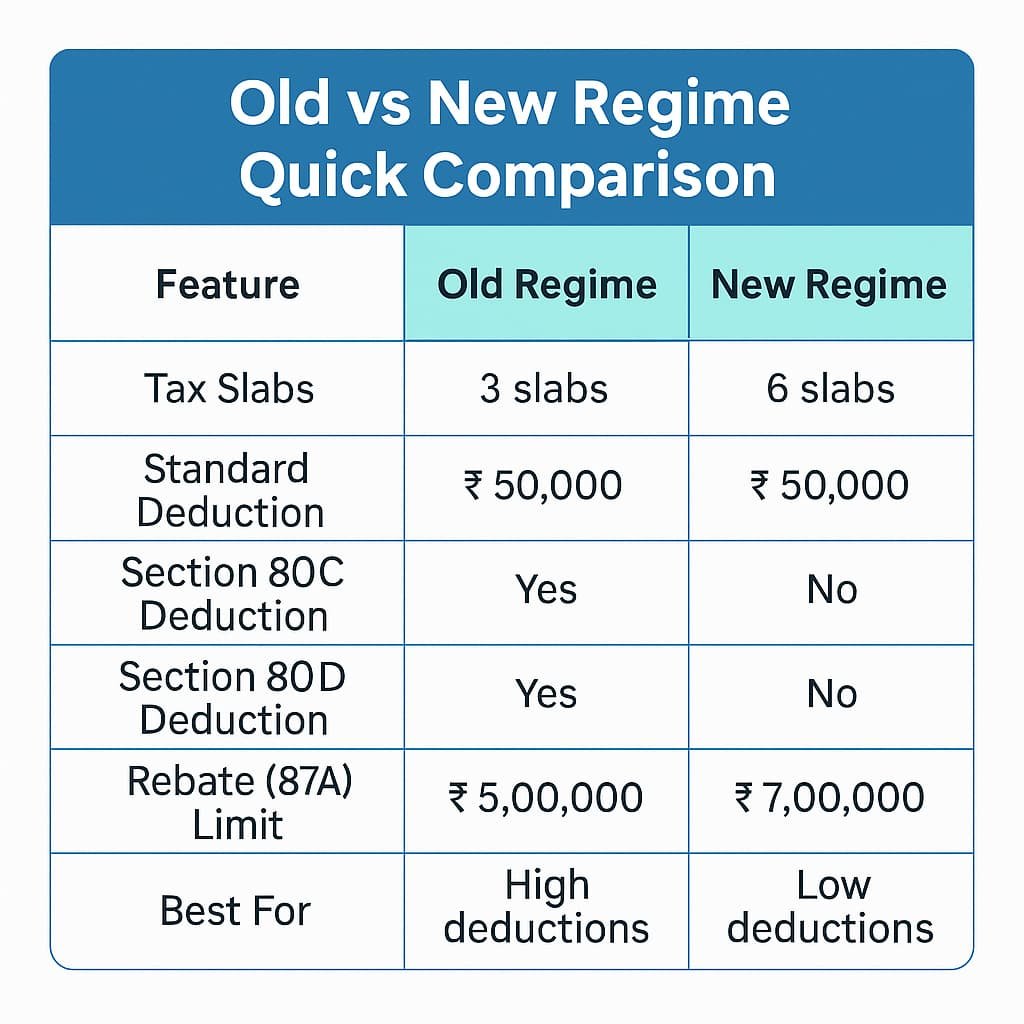

Step 3: Subtract deductions (only if you choose the old tax regime)

Standard deduction: ₹50,000 (for salaried individuals and pensioners).

Section 80C investments: up to ₹1.5 lakh (LIC, PPF, ELSS, etc.).

Section 80D: health insurance premiums.

Section 80TTA/80TTB: savings account interest exemption.

(Note: The new tax regime has very limited deductions — mainly the ₹50,000 standard deduction for salaried/pensioners.)

Step 4: Apply the correct income tax slab rates

New Tax Regime – FY 2024–25 (after Budget 2023 changes):

| Income Range (₹) | Tax Rate |

|---|---|

| 0 – 3,00,000 | Nil |

| 3,00,001 – 6,00,000 | 5% |

| 6,00,001 – 9,00,000 | 10% |

| 9,00,001 – 12,00,000 | 15% |

| 12,00,001 – 15,00,000 | 20% |

| Above 15,00,000 | 30% |

(Old regime slabs are different and allow more deductions — you can choose whichever benefits you more.)

Example Calculation – Temporary + Regular Job Income

Let’s say:

Regular salary income: ₹4,80,000/year

Temporary job income: ₹1,20,000/year

Total income: ₹6,00,000/year

Under the new regime:

First ₹3,00,000 → No tax = ₹0

Next ₹3,00,000 (₹3,00,001 – ₹6,00,000) → 5% = ₹15,000

Total Tax before rebate = ₹15,000

✅ Since your income is ₹6 lakh, you qualify for Section 87A rebate (available for taxable income up to ₹7 lakh under the new regime), so final tax = ₹0.

Use this quick reference to see which roles typically count as temporary (short-term/gig/project-based) and which are usually non-temporary (regular/permanent) for Indian tax context.

Note: “Temporary” refers to short-term, project-based, seasonal, or per-day/per-shift work without standard employment benefits.

Regardless of payment mode (cash/UPI/transfer), these earnings are typically taxable. Classification can vary by contract wording—

when unsure, report the income and consult a tax professional.Temporary vs Non-Temporary Jobs

Category Temporary Jobs (usually taxable as short-term/gig income) Not Temporary (regular/permanent employment) Retail & Events Education Freelance & Digital Logistics & Delivery Hospitality Field & Seasonal Creative & Events

Example Calculation (India – FY 2024–25)

Let’s say:

Main job salary: ₹4,80,000/year

Temporary job income: ₹1,20,000/year

Total income: ₹6,00,000/year

Deductions under old regime (e.g., investments, insurance): ₹50,000

Step 1: Calculate Taxable Income

Taxable income = ₹6,00,000 – ₹50,000 = ₹5,50,000

Step 2: Apply Old Regime Slabs (for individuals below 60 years)

| Income Range (₹) | Rate | Tax Amount |

|---|---|---|

| 0 – 2,50,000 | 0% | ₹0 |

| 2,50,001 – 5,00,000 | 5% | ₹12,500 |

| 5,00,001 – 5,50,000 | 20% | ₹10,000 |

Total Tax = ₹12,500 + ₹10,000 = ₹22,500

Step 3: Apply Rebate (If Eligible)

Since taxable income is above ₹5,00,000, the Section 87A rebate does not apply here.

Step 4: Adjust for TDS Already Deducted

If your employer or client already deducted ₹15,000 as TDS:

Tax Payable = ₹22,500 – ₹15,000 = ₹7,500

💡 Tip: If the same income was calculated under the new regime, you’d get the ₹7 lakh rebate (Section 87A) and pay zero tax — provided taxable income after standard deduction is within ₹7 lakh.

Income Tax Slab Rates – FY 2024–25

(For Individuals Below 60 Years – New Tax Regime)

| Income Range (₹) | Tax Rate |

|---|---|

| 0 – 3,00,000 | Nil |

| 3,00,001 – 6,00,000 | 5% |

| 6,00,001 – 9,00,000 | 10% |

| 9,00,001 – 12,00,000 | 15% |

| 12,00,001 – 15,00,000 | 20% |

| Above 15,00,000 | 30% |

Note: Under Section 87A, if your taxable income (after deductions) is up to ₹7,00,000 in the new regime, you are eligible for a rebate that reduces your total tax liability to zero.

Why Temporary Workers Often Miss Tax Payments

Many people doing short-term or gig work unknowingly skip paying taxes — not because they want to cheat the system, but because the rules aren’t always obvious. Here’s why it happens:

Payment is often in cash or via UPI – Without a payslip or formal record, it’s easy to forget that these earnings still count as taxable income.

No payslip or Form 16 is provided – Temporary employers usually don’t issue formal tax documents, so workers assume there’s nothing to declare.

Short job duration – A two-week project or a weekend event feels “too small” to bother with taxes, but even small earnings add up.

Unaware of tax slab impact – Many don’t realise that combining income from multiple jobs can push them into a higher tax bracket, increasing their total tax liability.

No TDS deduction – If the employer doesn’t deduct tax at source, the responsibility shifts entirely to the worker, and it’s easy to forget until the due date.

💡 Reality check: Whether you earn from a one-day event or a six-month contract, the Income Tax Department considers it income. Not reporting it could lead to penalties or notices later.

Is There Any Special Section for Temporary Job Income Tax?

In India, there is no dedicated section in the Income Tax Act that exclusively deals with temporary job income. Instead, such earnings are taxed under the existing heads of income, depending on the nature of work and the contract terms.

If the temporary work is like a salary (e.g., you were on a short contract with an employer), it will be taxed under “Income from Salary”.

If it’s freelance, gig, or project-based work, it generally comes under “Income from Business or Profession” — even if the duration was short.

If it’s casual income (e.g., honorarium for a guest lecture), it may fall under “Income from Other Sources”.

The tax rates, deductions, and exemptions are the same as for regular income — there is no separate lower rate for temporary jobs.

TDS (Tax Deducted at Source) may or may not be deducted by the payer. If not deducted, you must pay the tax while filing your return or through advance tax.

💡 Quick tip: Always check your Form 26AS or AIS to ensure that all temporary job payments are correctly reported before filing your return.

Tips to Stay Tax-Smart with Temporary Jobs

Paying tax on short-term work doesn’t have to be stressful — if you plan ahead, you can avoid last-minute shocks. Here’s how:

Keep all payment records – Save every proof, whether it’s a bank statement, UPI screenshot, or cash receipt. Even WhatsApp messages confirming payment can help you track income.

Track your total income – Maintain a simple Excel sheet or use a budget app to record earnings from both temporary and permanent work. This helps you know if you’re moving into a higher tax slab.

Set aside a tax fund – Every time you get paid, keep aside 10–20% in a separate account for future tax payments. This way, you’re never scrambling for cash at filing time.

Know your regime – Compare the old vs. new tax regime each year to see which saves you more based on your deductions.

File your taxes on time – The due date for individuals is usually 31st July of the assessment year. Filing late can mean penalties, loss of deductions, and delayed refunds.

Consider advance tax – If you earn significant income without TDS (common for temp jobs), paying advance tax quarterly can help you avoid interest charges.

💡 Quick win: Use the Income Tax Department’s free online calculator to estimate your liability early in the year — so there are no surprises later.

Common Mistakes to Avoid

Temporary workers often slip up on taxes because they assume “short-term work” means “no paperwork.” Here are the big pitfalls to watch out for:

Ignoring cash payments in your tax return – Just because you were paid in cash doesn’t mean it’s invisible to the Income Tax Department. Banks and digital platforms are increasingly monitored, and unreported income can trigger notices.

Not reporting freelance or gig work separately (when required) – If you do multiple temporary jobs or freelance projects, report them correctly under “Income from Other Sources” or “Profits and Gains from Business/Profession,” depending on the nature of work.

Missing deductions you qualify for – Investments in PPF, ELSS, life insurance, health insurance, and even education loans can reduce your taxable income. Forgetting them means paying more tax than necessary.

Waiting until the last minute – Leaving your tax calculation for the night before the deadline often leads to rushed errors, missed income entries, or forgotten deductions.

Assuming no TDS means no tax – If the employer hasn’t deducted tax at source, you might still owe it. In fact, you may also need to pay advance tax to avoid interest penalties under Sections 234B and 234C.

💡 Bottom line: Treat every rupee you earn — no matter how small — as part of your taxable income. It’s easier to track and pay than to fix a mistake later.

Temporary jobs are a fantastic way to boost your income — whether it’s to cover a sudden expense, save for a big purchase, or simply enjoy some extra spending money. But remember, the Income Tax Department doesn’t care if you worked for three days or three years — income is income, and it needs to be reported.

By keeping proper records, knowing your tax slab, and setting aside a portion of your earnings for tax payments, you can turn tax season from a stressful chore into a smooth, predictable process.

Think of taxes like rent — whether you stay for a day, a month, or a year, you still pay for the time you were there. Handle them proactively, and you’ll keep both your bank balance and your peace of mind intact.

If you’re aiming for financial independence, you might find our guide on Early Retirement Feasibility in India useful for long-term planning.

Unsure whether to invest in mutual funds or fixed deposits? Check out our analysis of SIP vs FD Returns (Inflation-Adjusted) to see what works better.

Earning money online? Here’s how to do a proper YouTube Income Tax Calculation in India to stay compliant.

Thinking of buying property? Understand the rules with our explainer on GST on Property Purchase in India.

Confused by GST-inclusive prices? Our GST Inclusive Price Breakdown makes it simple to see the tax component.

About Seva Funds & Important Disclosures

About the Author

Prashant SN

Education: MCom (Master of Commerce)

What I enjoy: Finance calculations and building easy tools for everyday decisions

Hi, I am Prashant SN. I studied MCom and I am interested in finance calculation. I started Seva Funds to share clean, fast calculators and no-nonsense explanations for India.

Disclaimer

This website and its content are for informational and educational purposes only. It is not intended to be and does not constitute financial, legal, or any other type of professional advice. We do not guarantee the accuracy, completeness, or usefulness of any information on the site. Always consult with a qualified financial professional before making any financial decisions.

🔗 More From SevaFunds

- How YouTube Income Is Calculated in India RPM, CPM, views → revenue math with simple examples and tips.

- AI Loans in India: Hidden Benefits Faster approvals, fairer risk checks, personalized offers—and key cautions.

- Calculate Credit Card Limit Based on Salary (India) Bank multipliers, income proofs, utilization tips, and upgrade strategies.