Increase CIBIL score from 750 to 800 by tightening a few simple habits, not chasing “hacks.” Your CIBIL score is just a three-digit snapshot (300–900) of how you use and repay credit; 750 is already good, but 800+ tells lenders you’re rock solid—so you usually get smoother approvals and better interest rates. The way up is straightforward: clean up any errors on your report, keep credit-card usage low, pay every bill on time, don’t apply for too many new loans/cards at once, and give it a little time. Do these consistently and that last 50-point climb becomes very doable.

Quick Overview: Steps to Move from 750 → 800

A quick, no-hype roadmap: clean up report errors, keep card usage low, pay on time, avoid bunching new applications, and build a healthy credit mix over time. Use this table as a simple checklist.

| Step | What to Do | Why it Helps | Typical Timeline* |

|---|---|---|---|

| Fix Report Errors | Dispute wrong late marks/unknown accounts | Removes unfair negatives holding score down | ~1 month |

| Lower Utilization (CUR) | Pay down revolving balances; mid-cycle payments | Shows low risk; reduces score drag | 1–2 cycles |

| Perfect Payment History | Autopay + early reminders | Most influential factor over time | Ongoing |

| Fewer New Applications | Space out hard enquiries | Avoids “credit-hungry” signal | Ongoing |

| Healthy Credit Mix | Balanced secured/unsecured (only if needed) | Shows you handle different credit types | Long-term |

| *Timelines are illustrative and can vary. Info-only; not financial advice. | |||

5 Steps to Boost Your CIBIL Score from 750 to 800

Step 1: Check and fix errors in your CIBIL report

Even strong profiles can carry small mistakes—a wrong address, a closed card still marked “active,” an unknown enquiry, or a late payment you actually paid on time. These can quietly hold you back from 800.

What to check (slow, line by line):

Personal details: Name, PAN, DOB, address.

Accounts: Are they all yours? Are closed accounts shown Closed? Are limits/balances correct?

Repayment history: Any late/missed marks you don’t recognize.

Enquiries: Lender pulls you didn’t authorize.

How to fix (simple steps):

Download your latest CIBIL report (you’re entitled to one free each calendar year).

Log in to myCIBIL and open Dispute Center.

Choose the item (Personal / Account / Enquiry), write what’s wrong and what it should be, and

Attach proof (closure letter/NOC, statement, bank confirmation), then submit and track.

What happens next:

CIBIL checks with the lender; the line may show “Under Dispute” until it’s updated.

After closure, re-download your report to confirm the correction has reflected.

Good to know:

Checking your own score is a soft enquiry—it doesn’t lower your score.

While a dispute is open, avoid applying for new credit unless necessary.

Tiny template (edit and use):

“Account ending ****1234 shows ‘active’ with ₹12,450 due. This loan was closed on 28-Mar-2024. Please update to ‘Closed’ with zero balance. Proof attached.”

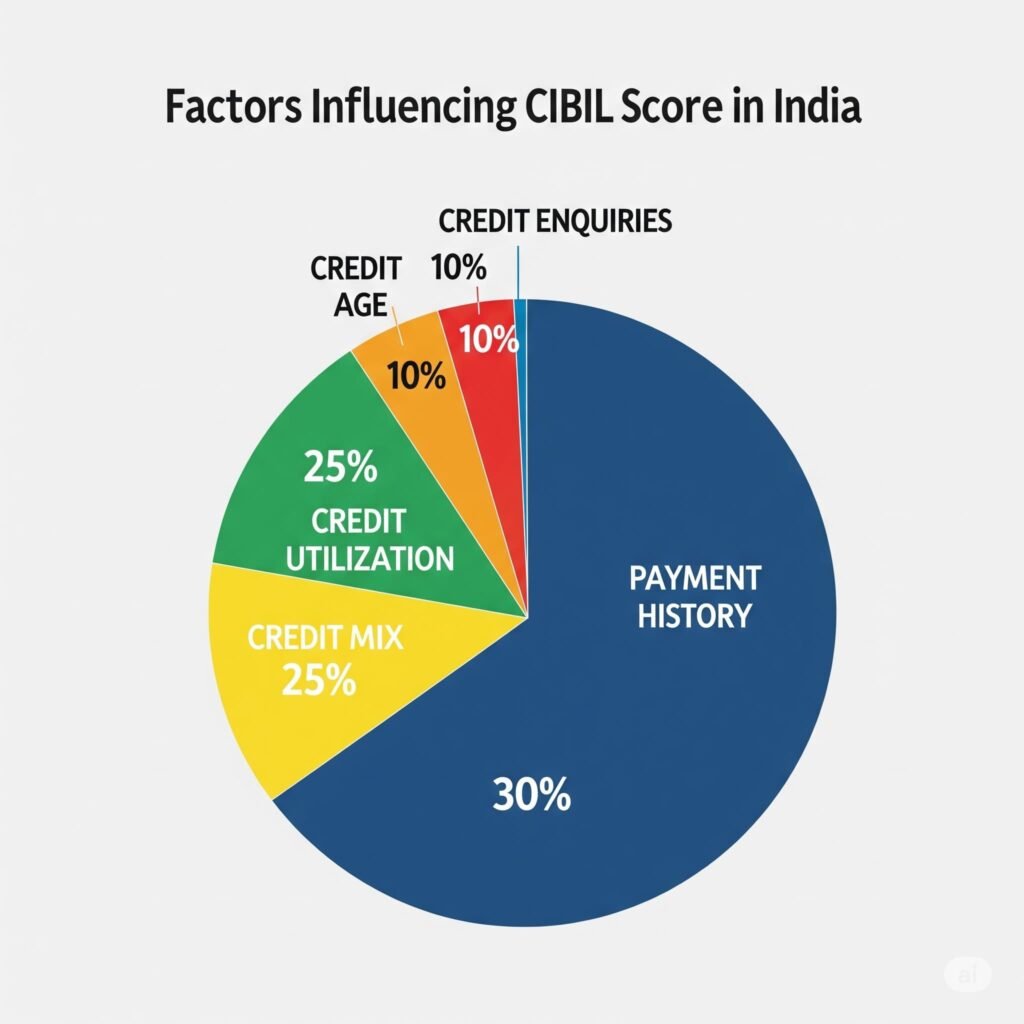

The 5 Key Factors That Influence Your CIBIL Score

A quick, at-a-glance map of what typically drives your score. Percentages below are widely cited industry estimates, meant for education only—not official figures.

| Factor | Approx. Weightage | How It Impacts Your Score |

|---|---|---|

| Payment History | 30% | Timely payments help; missed EMIs/card bills can cause noticeable drops. |

| Credit Utilisation Ratio (CUR) | 25% | Lower usage vs total limit is healthier; many aim for below ~30% overall/per card. |

| Credit Mix | 25% | Balanced secured + unsecured credit, managed well, signals stability. |

| Credit Enquiries | 10% | Multiple hard enquiries in a short period can pull the score down. |

| Credit Age | 10% | Longer, well-managed history is typically viewed positively. |

| Note: CIBIL doesn’t publicly disclose exact weights. Values above are commonly accepted industry estimates for educational use. | ||

Step 2: Pay off small debts strategically (lower your CUR)

Your Credit Utilization Ratio (CUR) is how much of your total credit limit you’re using. High CUR looks risky and can hold your score down. A simple, sensible target is to keep overall and per-card CUR under ~30% (pushing for 10–20% is even better when you’re aiming for 800).

Quick math example:

Total card limit = ₹2,00,000; current balance = ₹50,000 → CUR = 25%.

Pay ₹10,000 mid-cycle → balance ₹40,000 → CUR 20% (healthier).

Practical moves that work:

Clear small balances first. Knock off the easiest amounts on high-interest cards to drop CUR quickly.

Pay mid-cycle, not only on due date. Issuers usually report your statement balance; lowering it before the statement cuts often helps what gets reported.

Spread your spending. If you have multiple cards, don’t let any single card sit above ~30% while others are near zero.

Avoid big purchases right before the statement date. If you must, pay part of it immediately, then again before the statement cuts.

Don’t close high-limit/old cards while utilization is high. Losing that limit can spike your CUR overnight.

Nice-to-have (optional):

If your usage is genuinely low and stable, you can ask for a limit review on a well-managed card. A higher limit lowers CUR mathematically—just don’t treat it as permission to spend more.

CIBIL Score Ranges and Their Meaning

A quick visual guide to understand where a score sits and how lenders may view applications across ranges. Educational overview only.

| CIBIL Score Range | What it Means | Impact on Loan Applications |

|---|---|---|

| 300–549 | Poor | High chance of rejection. If approved, rates are usually very high. |

| 550–649 | Average | Applications considered with stricter terms and higher interest costs. |

| 650–749 | Good | Favorable position; most lenders will consider your application. |

| 750–799 | Very Good | Excellent position; access to competitive interest rates and better terms. |

| 800+ | Excellent | Best-in-class; lenders typically offer their most attractive rates and terms. |

| Note: Ranges and interpretations are educational; individual lender policies vary. | ||

Step 3: Maintain a perfect payment history

This is the big one. On-time payments carry the most weight in your credit profile, and even a single missed EMI or card bill can set you back. Make it hard to slip:

Set up a fail-safe system

Autopay the full amount for EMIs and credit cards wherever possible. If you’re unsure about cash flow, set full-amount autopay and keep a small buffer in that account.

Add a backup reminder 3–5 days early (phone/calendar). Pay a day or two before the due date to avoid last-minute glitches.

Align due dates with your salary credit if your bank allows date changes.

If cash is tight

Pay at least the minimum due on credit cards to avoid a reported miss—then clear the remaining balance as soon as you can. (Interest will accrue on revolving balances, so treat this as a short-term fallback, not a habit.)

Keep an EMI buffer (even half a month’s EMI helps) in the account used for auto-debits.

Housekeeping that prevents mistakes

Update autopay mandates whenever you change cards, close accounts, or switch banks.

Watch for payment posting delays—don’t wait till the last hour on the due date.

Avoid “settled” or “written-off” outcomes; if you miss, catch up quickly and speak to the lender so things don’t snowball.

A clean streak builds trust and makes that move from 750 to 800 much easier.

Quick Fixes to Improve Your CIBIL Score

A simple end-of-article checklist. Use these calm, low-risk habits to keep nudging your score upward.

| Action | Impact on Your CIBIL Score |

|---|---|

| Pay off your credit card bill in full | Immediate: Lowers Credit Utilisation Ratio (CUR); often shows up in the next cycle as healthier usage. |

| Close dormant or unused credit cards (only if fees/risks) | Caution/Delayed: Closing can reduce total limit and card age, which may raise CUR and hurt score. Consider keeping long-standing, no-fee cards open. |

| Correct errors on your credit report | Delayed: Disputes take time, but fixing inaccuracies (e.g., wrong late marks) can meaningfully help once updated. |

| Set up automated bill payments | Long-Term: Prevents missed EMIs/bills—payment history carries heavy weight in scoring. |

| Avoid applying for new loans/credit cards unnecessarily | Long-Term: Fewer hard enquiries and a calmer profile help your score stabilize and improve. |

| Note: Examples are for education only—results vary by profile and lender practices. Info-only; not financial advice. | |

Step 4: Avoid multiple loan applications at the same time

Every new loan or credit-card application triggers a hard enquiry on your report. Too many, too close together, can make you look credit-hungry and nudge your score down. Keep it calm and deliberate.

What to do

Apply only when you really need it. Space applications a few months apart.

Try eligibility/pre-qualification checks first. Many lenders can do a soft check that doesn’t affect your score.

Rate-shopping? For things like a home or car loan, compare offers within a short window instead of spreading enquiries over months. It signals you’re checking options for one need.

If you’re declined, pause. Understand the reason (utilization too high, recent late payment, thin history), fix it, and wait before reapplying.

Avoid festival FOMO. Don’t stack multiple new cards just for short-term discounts or cashback.

Close any application you won’t proceed with. Don’t leave half-done forms that may still lead to pulls.

Good to know

Soft enquiries (like checking your own score) don’t harm your score; hard enquiries can.

Opening many new accounts at once can also shrink the average age of your credit, which may hold your score back temporarily.

Step 5: Diversify your credit mix (longer-term)

Lenders like to see that you can handle different kinds of credit—not just credit cards. A calm, balanced profile (managed well over time) can make the move from 750 to 800 smoother.

What “mix” means (simple):

Secured credit: backed by a security (home loan, auto loan, gold loan).

Unsecured credit: no collateral (credit cards, personal loans, BNPL lines).

Why it helps:

Showing you can manage both types responsibly—on time, every time—signals stability. It’s not a magic switch, but it strengthens your profile as months and years pass.

How to build a healthy mix—organically (don’t force it):

If you already plan a purchase (bike, laptop, appliance), taking a small, affordable EMI and repaying perfectly can add variety to a card-only profile.

If you only have a home/auto loan, consider keeping one no-fee credit card and use it lightly (under ~30% of limit) with full bill payment each month.

Prefer fewer, well-managed accounts over many scattered ones. Quality beats quantity.

If you can comfortably do so, pre-pay high-interest debt. Paying less interest is usually smarter than chasing a tiny score gain from “active mix.”

What not to do:

Don’t take a loan you don’t need “just for score.” That can cost interest and add risk.

Don’t open multiple new accounts at once; it lowers average account age and adds hard enquiries.

Don’t let BNPL/personal loans pile up—those are unsecured and can weigh on your profile if used heavily.

Don’t close your oldest good-standing card without a reason—account age helps your overall depth.

Reality check (timeline):

Credit mix is a slow lever. Think months to years, not days. Keep doing the basics—on-time payments, low utilization, spaced-out applications—and let the positive data age.

Factors Influencing Your CIBIL Score in India

This pie chart visually breaks down the key factors that determine your CIBIL score and their relative importance. As you can see, Payment History is the most significant factor, accounting for 30% of your score, followed by Credit Utilization and Credit Mix, each at 25%. The remaining 20% is split between Credit Age and Credit Enquiries. Understanding these weightages is the first step toward strategically improving your credit score.

Moving from 750 to 800 isn’t about tricks—it’s about steady habits done right:

Fix report errors so your profile reflects the truth.

Lower utilization by paying down revolving balances (keep it comfortably under ~30%).

Never miss a due date—set autopay and early reminders.

Apply selectively—avoid clusters of hard enquiries.

Build a healthy mix over time (only when it fits your real needs).

An 800+ CIBIL score won’t show up overnight, but small, consistent actions add up. With a cleaner report, low usage, and a spotless payment trail, you’ll strengthen your chances for better rates, smoother approvals, and more negotiating power.

About Seva Funds & Important Disclosures

About the Author

Prashant SN

Education: MCom (Master of Commerce)

What I enjoy: Finance calculations and building easy tools for everyday decisions

Hi, I am Prashant SN. I studied MCom and I am interested in finance calculation. I started Seva Funds to share clean, fast calculators and no-nonsense explanations for India.

Disclaimer

This website and its content are for informational and educational purposes only. It is not intended to be and does not constitute financial, legal, or any other type of professional advice. We do not guarantee the accuracy, completeness, or usefulness of any information on the site. Always consult with a qualified financial professional before making any financial decisions.

🔗 More From SevaFunds

- Calculate Credit Card Limit Based on Salary (India) Bank multipliers, documentation, and utilization tips to protect your score.

- AI Loans in India: Hidden Benefits How new scoring models affect approvals, interest rates, and credit health.

- Is Household Income Monthly or Yearly? What lenders mean by income—and how to present it for better terms.