UPI vs bank app—if you’ve ever wondered, “Should I use a separate UPI app like PhonePe or Google Pay, or just stick with my bank’s app?” you’re not alone. Dedicated UPI apps are built for quick, everyday payments and simple transfers, while bank apps act as your full financial hub for balances, statements, FDs, loans, cards, and more. This guide keeps things practical and brand-neutral (names above are examples, not endorsements), comparing both on features, security, and convenience so you can quickly decide what actually fits your day-to-day life.

Understanding UPI apps

What they are: Standalone payment apps built around UPI for instant transfers. Link one or more bank accounts, then pay via QR, UPI ID, mobile number, or contacts—basically a payment remote that works across many banks.

Why people like them (pros):

Fast, simple UI for everyday payments

Works with most banks/merchants; scan any standard QR

Extras like bill pays, recharges, reminders, occasional rewards

Clear alerts so you know instantly if a payment succeeded

Where they fall short (cons):

Limited core banking: not ideal for FDs/RDs, detailed statements, or card controls

Some users feel safer inside their official bank app for sensitive tasks

Promos/banners can be distracting; keep notifications tidy

Best for: quick daily spends, splitting bills, paying any QR, switching between multiple linked bank accounts.

Not ideal for: deep account work (statements, service requests, large transfers).

Understanding bank apps

What they are: Your bank’s official mobile app (e.g., SBI, HDFC Bank, ICICI Bank). It’s a full-control dashboard for your accounts, usually with a UPI section built in.

Core strengths (pros):

Comprehensive banking: balances, statements, transfers, card controls, FDs/RDs, loans, investments, service requests—all in one place.

“Official app” trust: Many users feel more confident staying inside their bank’s ecosystem for sensitive tasks.

Detailed data & records: full history, PDF statements, tax summaries, downloadable proofs, and direct support routes.

Possible drawbacks (cons):

Heavier interface: Can feel busy if you just want to send ₹300; often more taps than a dedicated UPI app.

Fewer lifestyle extras: Recharges, rewards, or cross-merchant features may be limited.

Single-bank focus: If you use multiple banks, switching profiles isn’t always seamless.

Best for: deeper banking work—statements, FDs/RDs, card settings, large transfers, service requests, and periodic account reviews.

Not ideal for: ultra-quick, everyday QR splits where a dedicated UPI app is usually faster.

Hidden Costs and Considerations

Subtle differences that add context beyond basic pros/cons. Policies change—always confirm in your app or with your bank.

| Consideration | UPI App | Bank App |

|---|---|---|

| Transaction Fees | Generally zero for everyday consumer UPI transfers; campaigns may vary. | Some services (NEFT/RTGS, certain transfers) may have fees; many banks offer free tiers or time-bound waivers. |

| Data Usage | Needs active internet for setup and payments. | Usually needs internet; some banks also support limited SMS/USSD features (less common now). |

| Push Notifications | Typically instant, clear success/failure alerts. | Push + SMS/email; timing can vary across services and devices. |

| Ease of Setup | Quick onboarding via registered mobile + UPI PIN creation/confirmation. | Often requires internet banking/MPIN setup, registered mobile, and card/OTP activation steps. |

| Troubleshooting | May involve both app support and your bank for certain issues/refunds. | Directly contact your bank; integrated ticketing and branch/phone support options. |

| Info-only; not financial advice. Features, fees, and timelines vary by bank/app and can change. | ||

Which one should you use?

There isn’t a single winner. Pick based on how you actually pay and what you manage day to day.

Use a UPI app if…

You mostly make quick, everyday payments—friends, local shops, delivery folks, cabs.

You value speed + a simple flow more than full banking features.

You like bill reminders, small rewards, and a unified QR experience across banks.

You often switch which bank account you pay from.

Use a bank app if…

You want one app for everything—balances, statements, card controls, FDs/RDs, loans, investments, service requests.

Security confidence matters and you prefer to transact inside your bank’s official app.

You handle larger or sensitive tasks—adding beneficiaries, setting standing instructions, downloading proofs for taxes/claims.

Real-world tip for most people: Use both—a UPI app for fast daily payments and your bank app for deep banking and monthly reviews. Keep device/app locks on, double-check payee names, and never share OTP/UPI PIN. (Info-only; not financial advice.)

Security Comparison — UPI Apps vs Bank Apps

A quick, practical look at how common safety practices map to each option. Keep both apps secure for best results.

| Practice | UPI Apps | Bank Apps | Notes |

|---|---|---|---|

| Lock the device | Works best with strong phone passcode/biometric; UPI PIN authorizes each payment. | Strong device lock + app login/MPIN/biometric; many banks use device binding. | Never share OTP/UPI PIN; keep OS updated. |

| Use in-app locks | Typically supports app PIN/biometric; some offer screenshot controls. | App PIN/biometric standard; often stricter session timeouts. | Enable every security toggle available. |

| Phishing & fake links | UPI reminders warn: no one needs your OTP/UPI PIN. | Banks reiterate: never share login/OTP; use in-app support. | Ignore unsolicited calls/links; contact support from inside the app. |

| Verify payee | VPA/QR shows receiver name before you pay. | Beneficiary name shown after adding payee; large transfers may need cooling period. | Double-check name/ID every time. |

| Notifications & alerts | Fast success/failure push notifications. | Push + SMS/email statements and alerts. | Keep alerts ON—they’re your early warning. |

| Remove old devices | De-register old phone when you switch numbers/devices. | Device management inside settings; some require re-activation. | Clean up old logins after phone changes/SIM swaps. |

| Small test first | Send a ₹1–₹10 test payment to new payees. | New beneficiaries often have lower limits initially. | Scale amounts only after confirmation. |

| Monthly review | Basic history helps spot mistakes. | Full statements, PDFs, and filters for audits. | Download a statement monthly for records. |

| Info-only; not financial advice. Features, limits, and policies vary by bank/app and can change. Use official support within your app for issues. | |||

Real-life scenarios

You run a small home business

Use a UPI app for: daily QR payments and quick customer receipts.

Use your bank app for: weekly reconciliation, statements, and GST records.

Why this works: fast checkout at the counter + clean records for compliance.

Pro tip: label transactions where possible; export a statement every Friday.

Salary in Bank A + savings in Bank B

Use a UPI app for: switching the pay-from account on the fly.

Use both bank apps for: statements, card controls, and transfers between accounts.

Why this works: one payment surface for everyday spending, full control inside each bank.

Pro tip: name your linked accounts clearly (e.g., “Salary-A”, “Save-B”) to avoid mistakes.

Helping parents with payments

Use a UPI app for: simple bill payments and small transfers—they’re easier to teach and use.

Keep the bank app for: viewing passbook/FDs, downloading proofs, and contacting support.

Why this works: low-friction daily payments + reliable access to official records.

Pro tip: turn on bill reminders and transaction alerts; keep limits modest.

You travel a lot

Use two UPI apps/accounts (optional): a backup handle in case one rail is down.

Bank app checklist: enable international SMS/email alerts (if offered), verify device settings before trips.

Why this works: redundancy for payments + timely alerts if something looks off.

Pro tip: lock apps with biometrics, remove old devices, and test a small transaction after landing.

UPI Apps vs. Bank Apps: A Feature-Based Comparison

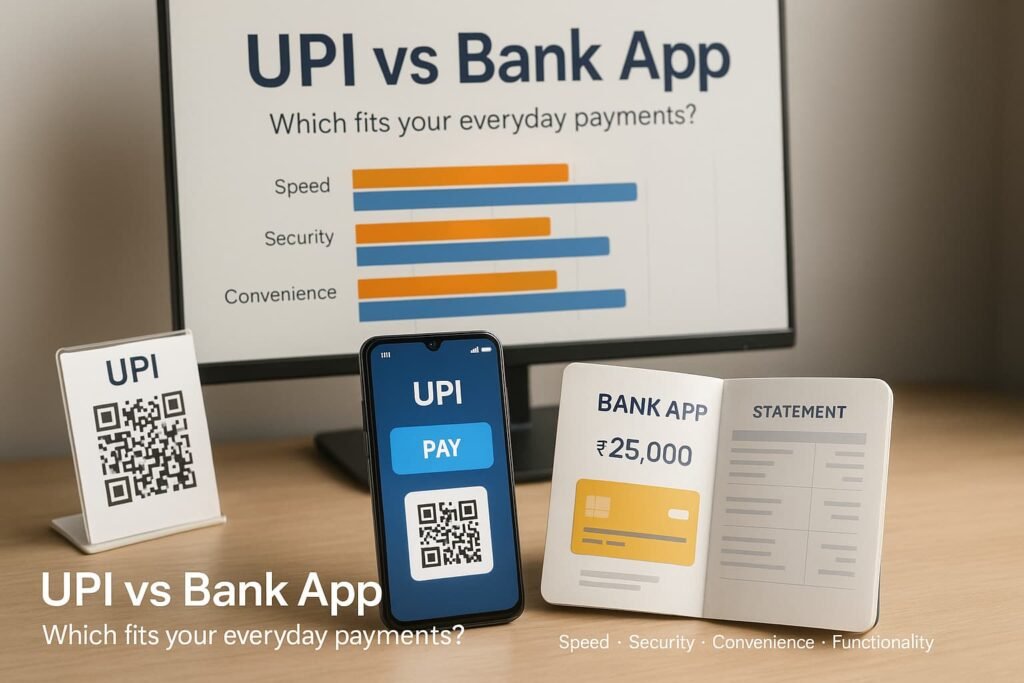

This graph visually compares UPI apps and bank apps across four key metrics. As you can see, UPI apps generally score higher in Speed and Convenience due to their streamlined design for quick payments. In contrast, bank apps often score higher in Functionality because they are a comprehensive hub for all banking services, from investments to loans. Security is a matter of perception, though both are highly secure, as they are often built on the same underlying infrastructure.

Direct Comparison: UPI App vs. Bank App

This chart visually compares UPI apps and bank apps across key metrics.

Illustrative comparison only (1–5 scale). Not ratings; features and policies vary by bank/app and can change.

Conclusion

There isn’t a single “best” choice—there’s the best fit for how you actually use money. UPI apps shine for quick, everyday payments and a smooth QR/P2P experience. Bank apps win when you need depth: statements, FDs/RDs, card controls, large transfers, and official support. Most people in India get the best results by using both: a UPI app as the fast lane for daily spends, and the bank app as the control room for everything else.

Whichever you choose as your default, keep basics tight: lock your phone and apps, never share OTPs or UPI PINs, double-check payee names, and keep transaction alerts on. Once a month, open your bank app, review activity, and download a statement so your records stay clean.

Features and fees change, so check inside your app or with your bank when something matters. Do that, and you’ll enjoy the convenience of UPI without losing the clarity and control your bank app provides. Info-only; not financial advice.

FAQ

1) Can I use both a UPI app and my bank app?

Yes. Many people do: UPI app for quick daily payments; bank app for statements, FDs/RDs, card controls, and support.

2) Which is safer—UPI app or bank app?

Both ride on banking/NPCI rails and require your UPI PIN/MPIN. What really matters is your device lock, app lock, and not sharing OTP/UPI PIN.

3) Do UPI payments have fees?

Everyday consumer UPI transfers are generally free. Policies can change—always check inside your app/bank for current charges.

4) Are there transfer limits?

Yes, limits exist and vary by bank/app, account type, and risk checks. See the “limits” or “help” section inside your app.

5) A payment is pending/failed—what should I do?

Keep the reference number visible. Most pending payments auto-resolve within the stated window. If not, raise a ticket from inside the app (UPI app and/or bank app).

6) Will checking my balance or using these apps affect my credit score?

No. Viewing balances/statements does not impact credit scores.

7) I changed phone/number—how do I stay safe?

De-register the old device, re-activate on the new phone, and update alerts. Remove any unused devices from app settings.

8) Can I link multiple bank accounts to one UPI app?

Yes. You can link several accounts and choose the pay-from source before paying. Keep names/labels clear to avoid mistakes.

9) What if I send money to the wrong person?

Act quickly. Contact support from inside the app and also inform your bank. Reversals require the recipient/bank to cooperate; success isn’t guaranteed.

10) Are UPI apps okay for small businesses?

Often yes for day-to-day QR payments. For records, reconcile in your bank app and download statements regularly.

11) Can I use these abroad?

UPI acceptance outside India is limited and evolving. Bank apps may still work for viewing accounts/alerts. Check your bank/app for current availability.

12) My phone is lost—what now?

Use your carrier/bank/app instructions to block SIM, log out/disable the app, and reset UPI/MPIN. Change device/app locks on the replacement phone.

About Seva Funds & Important Disclosures

About the Author

Prashant SN

Education: MCom (Master of Commerce)

What I enjoy: Finance calculations and building easy tools for everyday decisions

Hi, I am Prashant SN. I studied MCom and I am interested in finance calculation. I started Seva Funds to share clean, fast calculators and no-nonsense explanations for India.

Disclaimer

This website and its content are for informational and educational purposes only. It is not intended to be and does not constitute financial, legal, or any other type of professional advice. We do not guarantee the accuracy, completeness, or usefulness of any information on the site. Always consult with a qualified financial professional before making any financial decisions.

🔗 More From SevaFunds

- GST-Inclusive Price Breakdown Decode “₹X incl. GST” on UPI receipts into base + tax with examples.

- GST Calculation Guide for the Common Man Quick formulas to verify bills you pay via UPI or bank apps.

- Calculate Credit Card Limit Based on Salary (India) Cards vs UPI: know safe limits, utilization tips, and upgrade strategies.